Agora Overview

Agora moves investor management out of outdated Excel spreadsheets and into a modern, end-to-end digital platform where users can manage assets, relationships, reporting, documents, and more from one dashboard while leveraging the power of automation.

With Agora’s comprehensive real estate investment management platform, companies seeking to raise and preserve capital can provide their investors with the best real estate investment experience while also improving their professional image.

The best part? Agora saves companies valuable time while maintaining and improving their ability to raise capital, manage investor relations, manage active investments, and handle financial administration.

Our Take On Agora

Best for real estate companies looking for an all-in-one investment management tool.

Agora is a top choice for real estate companies looking for a comprehensive real estate investment management platform that helps them raise capital, manage their investors, and streamline operations. Agora includes a fundraising platform, a customizable investor portal and CRM, financial automation, investor reporting, and document management.

Pros

Pros- Agora is a user-friendly, comprehensive, customizable investment management solution.

- The investor portal gives users an intuitive, transparent view of their investments.

- Agora can support all entity types, including open-end funds, closed-end funds, syndications, and other unique situations.

- The waterfall automation tool offers a wide range of waterfall structures, with supporting calculations shown.

- Custom report builders allow users to take care of all their investor reporting, streamlining operations.

- Users can send distribution payments to their investors directly from the platform.

- Agora also offers a range of financial services, including tax preparation and bookkeeping.

Cons

Cons- Agora is a young startup with a short track record compared to some of its competitors.

- With so many features, customizations, and a constant stream of new feature releases, users may face a steeper learning curve to get started.

Pros Explained

User-friendly, comprehensive, customizable solution: The Agora platform offers all the tools a real estate company needs to manage its investors. Companies can market and fundraise for any investment type, manage commitments and capital, calculate and pay distributions, create and send investor reports, manage investor relationships, and more all in one platform. Almost everything can be customized for a company’s specific needs.

Top-notch investor portal: Agora’s customizable portal gives investors complete visibility into their investments, including financials, reports, and real-time updates. The beautifully designed, easy-to-use Investor Portal also improves optics compared to sending unwieldy spreadsheets to investors via email. Custom report builders allow users to take care of all their investor reporting, streamlining operations. Agora also offers other financial services, like tax preparation and bookkeeping.

Waterfall automation tool: Calculating investor distributions can be time-consuming and tedious. Agora’s waterfall tool makes these calculations quick and easy. The tool can support even complex splits while showing exactly how calculations were made.

All types of investments: While many investment management platforms focus more on syndications, Agora can support all investments, including open-end funds, closed-end funds, syndications, and other unique situations. Open-end fund support is particularly attractive, as open-end funds can be more complex to manage.

Cons Explained

Short company track record: Agora, founded in 2019, has rapidly emerged as a leader in real estate investment management. Following its $20M Series A in 2022, Agora secured $34M in a Series B round in 2024, led by Qumra Capital with participation from Insight Partners and Aleph. The Agora platform helps real estate firms globally manage over 100K investors and $210B AUM across every single asset class.

Steep learning curve: Since Agora allows companies to customize almost anything, users may find their initial onboarding overwhelming. Fortunately, Agora’s dedicated customer service can promptly ensure smooth onboarding. The platform may be difficult to manage at the outset, but having a dedicated account rep to assist you at every step of the way is invaluable.

Agora Product Offerings

Agora offers comprehensive tools and services to assist real estate companies with fundraising and investment management. Some of Agora’s key features include:

Investor Portal

Agora’s Investor Portal is an advanced, user-friendly platform that enhances how real estate companies interact with their investors.

The dashboard centralizes all vital investment information in a single view, allowing investors to see a real-time overview of their entire portfolio in a visually appealing card-style layout with clear titles and tags for easy navigation. This dashboard is also customizable, meaning companies can present data tailored to the needs of individuals or groups of investors and can offer visuals like charts and graphs to communicate investment details effectively.

Investors can delve deeper into any investment, accessing all related updates, metrics, graphs, transactions, and documents. The dashboard also facilitates new investments with a Live Offering module that leads investors to data rooms or directly into the subscription process.

Investor CRM

Agora’s CRM is a tool for real estate firms to manage investor relationships efficiently. It simplifies the entire investor lifecycle, from prospecting to deal closure and ongoing management. The CRM offers smart filtering, automation rules, dynamic lists, and advanced searching, enabling a comprehensive and clear view of investor data.

With features allowing for bulk actions and one-click operations, the CRM makes sharing reports, distributing documents, and mass communications easy. It also logs and tracks all investor comms., ensuring everything runs smoothly.

Fundraising Platform

Agora’s fundraising tools allow companies to market deals, manage prospects, and quickly facilitate the subscription process. Their solution provides a centralized offering page that displays all prospects and their statuses within the fundraising cycle, eliminating the need for external tracking methods like clunky spreadsheets. Customizable columns allow users to prioritize and access the most relevant data quickly.

A standout feature of Agora’s platform is the Smart Questionnaire, which transforms the subscription and investor onboarding process by converting complex documents into user-friendly, interactive forms. Investors benefit from features like pre-filled fields, mobile-friendly access, and multi-user collaboration, making it easier to complete and review subscription agreements. This not only simplifies the onboarding process but also reduces errors, accelerates timelines, and enhances investor satisfaction.

Agora even adapts to various investor types, from individuals to family offices and institutional investors, offering tailored subscription processes and collaborative review capabilities. This ensures that high-net-worth individuals, family offices acting on behalf of clients, and institutional investors with multiple stakeholders can all navigate the fundraising process effectively and make more informed decisions.

Agora’s fundraising software integrates seamlessly with core functionalities such as the Investor Portal, CRM, reporting tools, and document management systems, creating a cohesive fundraising ecosystem.

Distribution Automation

Agora’s financial automation allows companies to calculate and execute distributions straight to investor bank accounts. Firms can transfer distributions with quick ACH processing and track everything in their dashboard. Agora can handle capital transactions, maintain investor cap tables, automate complex waterfall calculations, and facilitate real-time investor reporting within a single platform.

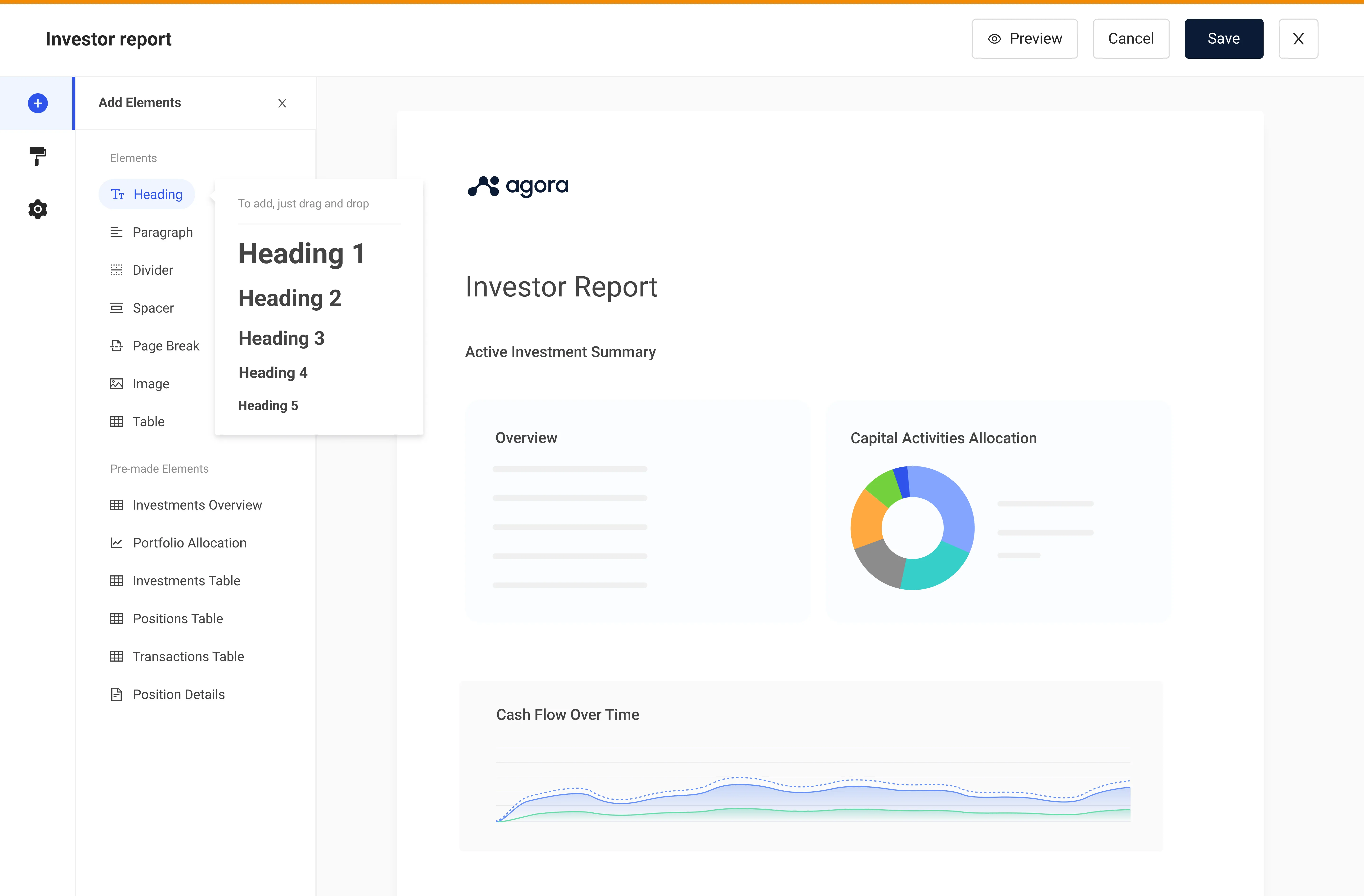

Investor Reporting

Agora’s investor reporting system keeps investors informed 24/7 through customizable templates and automated processes for generating and delivering various reports. With Agora’s Report Builder, creating professional, tailored investor reports has never been easier. This tool allows real estate firms to design visually appealing and branded reports, combining rich data insights with professional layouts to ensure clarity and impact.

The platform supports the creation of quarterly, annual, and periodic reports, statements, and other essential documents tailored to meet the needs of diverse stakeholders. Agora’s reporting capabilities also streamline traditionally labor-intensive tasks like automating K-1 distributions, saving time, and reducing errors. With the Report Builder and other robust features, Agora empowers firms to deliver seamless, efficient, and professional investor reporting that enhances transparency and strengthens investor trust.

Document Management

Agora’s document management system is tailored specifically for real estate investments, offering a streamlined way to organize, access, and manage documents. It allows users to store and categorize various offering docs and financials, providing easy retrieval through advanced search and filtering options and ensuring secure document delivery. The system also features smart bulk uploads, saving time during tax season by automatically assigning K-1s and other tax forms to investors.

Tax Services

For an additional charge, Agora offers K-1 tax preparation. Agora ensures accurate and efficient tax filings by partnering with selected CPA firms specializing in real estate. Investment managers benefit from a dedicated CPA to handle communications and document management directly within Agora’s platform. This service simplifies the process by directly sending K-1s to investors at a significantly reduced cost compared to traditional CPA firms.

Bookkeeping

In addition to accounting assistance for tax season, Agora identified a need for quality bookkeepers to track finances throughout the year. For an additional charge, Agora’s bookkeeping service provides clients with an in-house team that can handle all necessary functions, such as accounts payable, accounts receivable, and account reconciliation.

User Experience

Agora’s user interface is clean and visually appealing. While new users may experience a steeper learning curve as they customize the software to meet their needs, the Agora support team is always available to help. However, Agora’s offerings make it as intuitive and straightforward as possible for users to get the most out of the software.

From an investor perspective, Agora is also intuitive and user-friendly. Investors can easily view their various investments, documents and reports, and distribution history while communicating directly with the real estate company in one easy-to-use portal.

Customer Support

Agora offers multiple ways to connect with its customer support team, including dedicated onboarding specialists, customer success managers, and other account reps, as well as an automated site chatbot.

Users can also get support by emailing [email protected] directly. Subscribers also receive dedicated customer success reps who help ensure a seamless onboarding process and are always available to answer questions.

Pricing

Agora offers a tiered pricing structure tailored to syndicators, general partners (GPs), and enterprises:

- The Essential plan starts at $749/month and includes core features such as the Investor Portal, CRM, fundraising tools, and the Report Builder.

- The Professional plan builds on Essential with advanced fundraising tools, institutional-grade data room access, enhanced reporting capabilities, and an expanded template library.

- The Enterprise plan offers customized solutions, API access, data warehouse exports, and white-glove onboarding services for large-scale enterprises.

Additional services, including CPA-managed K-1 preparation, bookkeeping, and cross-border payment solutions, can be integrated into any plan for an extra fee, ensuring flexibility and scalability to meet firms’ specific needs.

Competitors

Juniper Square

Juniper Square is one of the biggest real estate investment management platforms on the market today. Juniper Square is specifically designed for real estate investment managers to help streamline fundraising, investor reporting, and investment management processes. Juniper Square is used by a wide range of real estate firms, including private equity firms, developers, and fund managers.

InvestNext

InvestNext is a real estate investment management software company focused on serving syndicators and users who are growing small firms. It provides a holistic approach to managing real estate investments. Their platform offers solutions for raising capital, managing waterfall distributions, and securing investor commitments.

Appfolio Investment Manager

As one-half of the Appfolio property software suite alongside Appfolio Property Manager, AppFolio Investment Management is a cloud-based software platform designed to help investment managers streamline their operations and manage their portfolios more efficiently. It offers portfolio tracking, performance reporting, client communication tools, and compliance monitoring.

SponsorCloud (formerly SyndicationPro)

SponsorCloud is a real estate syndication software company specifically focused on the needs of real estate syndication companies. The software helps sponsors raise capital and manage assets and includes a CRM, investor portal, fundraising automation, and ACH payments.

FAQs

Agora is a comprehensive real estate investment management platform that helps companies raise capital, manage their investors, and streamline operations. Agora includes a customizable investor portal, CRM, fundraising tools, document management, investor reporting, and financial automation.

While Agora doesn’t offer a free trial, the company has many interactive product tours that allow potential users to get a first-hand look at the software’s key features and functions. Potential users can also request a live product demo with the Agora team.

Agora is geared toward real estate management companies that manage syndications, open- and close-ended funds, debt funds, and more.

Agora’s pricing starts at $749/month and is based on a firm’s Equity Under Management (EUM). For an additional charge, subscribers can have Agora’s CPAs handle their K-1 preparation from start to finish and use Agora’s team of bookkeepers to manage a company’s financial records.

How We Evaluated Agora

When evaluating Agora, we looked at several factors, including:

- Product offerings: We dug into the depth and breadth of Agora’s features, products, and services and what sets them apart in the industry.

- Pros and Cons: We weighed what potential customers should look for against the features that would make them stand out among competitors.

- Ease of Use/Functionality: We tested how user-friendly and intuitive the Agora platform is and how quickly a new user could understand its functionality.

- Customer Support: We evaluated Agora’s support network for response time, training materials, and accessibility to customer service reps.

- Pricing and transparency: We examined how Agora’s products are priced and how readily available pricing information can be found.

Summary of Agora Review

Many real estate companies constantly seek new ways to stay lean and automate operations as much as possible. For many companies, investment management tasks are tracked in siloed Excel spreadsheets, making fundraising, investor management, distributions, and reporting a time-consuming headache.

Agora aims to be a comprehensive, end-to-end solution for real estate investment managers, helping to streamline operations, cut costs, and focus on their core activities of building relationships and closing deals.

With a clean interface and professional-looking investor portal, Agora is an excellent choice for companies looking for an all-in-one investment management tool. The depth of software solutions and customizable features included in the subscription plan is a key benefit.

A fully integrated and fully customizable investment management solution like Agora is critical to running a successful real estate company. By adopting Agora’s platform, real estate investment firms can enhance their professional image and deliver an exceptional investment experience to every investor.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!