Appfolio Investment Manager Overview

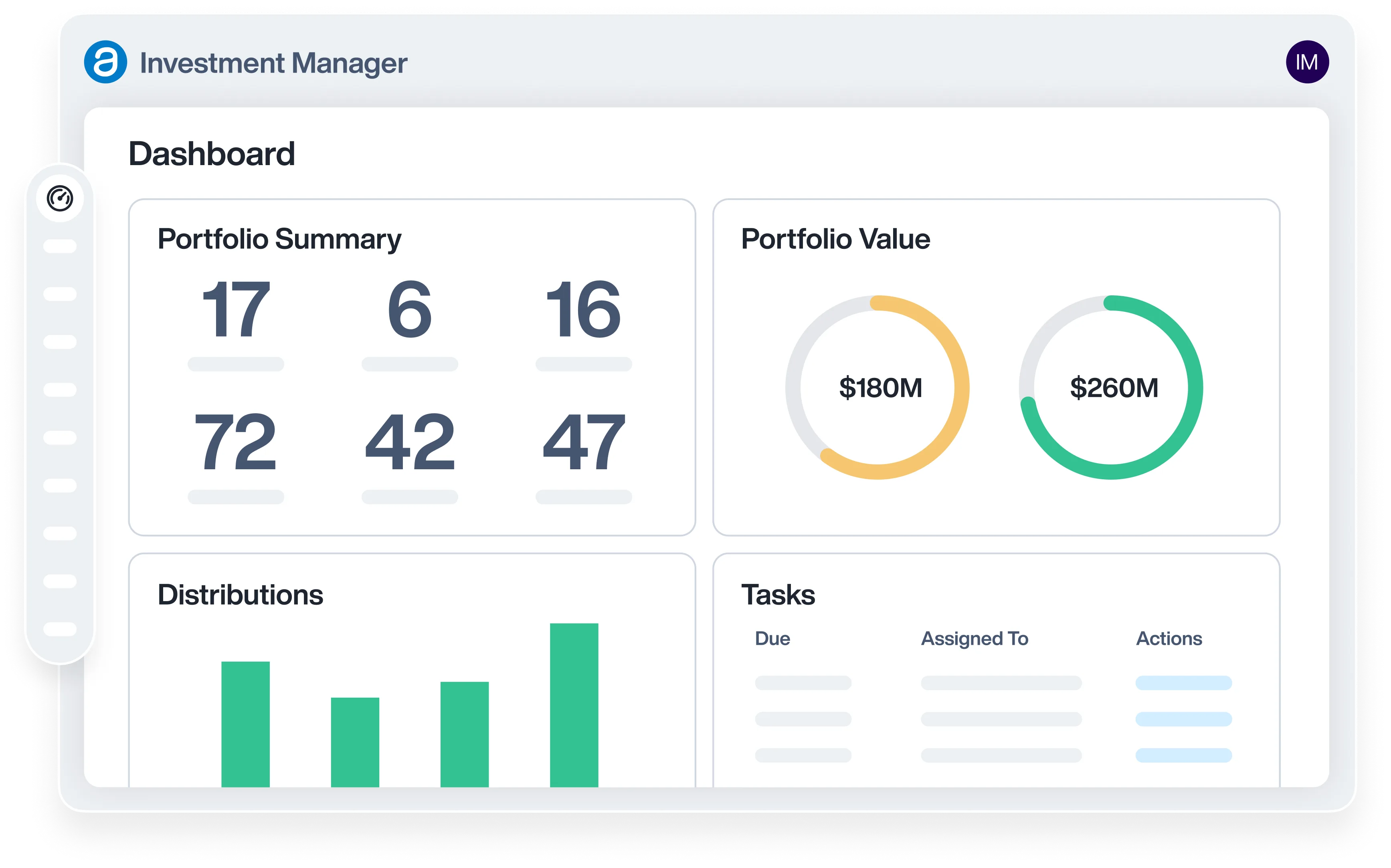

AppFolio Investment Manager is a powerful, all-in-one investment management platform designed to help real estate firms efficiently raise capital, manage investor relations, and oversee portfolio performance from a single, AI-powered dashboard.

By eliminating manual processes and disconnected spreadsheets, AppFolio streamlines fundraising, investment tracking, and financial reporting, allowing GPs to focus on scaling their business rather than administrative tasks. With automated workflows, an intuitive investor portal, and seamless integration with AppFolio’s property management software, CRE investment firms can enhance investor engagement, simplify complex fund structures, and gain real-time insights across their asset lifecycle.

The result? A more efficient, transparent, and scalable investment management experience that empowers owners to make data-driven decisions and optimize their operations.

Our Take On Appfolio Investment Manager

Best for users looking for a white-label investment management platform with seamless asset management integration.

AppFolio Investment Manager is designed to streamline real estate investment management for GPs and LPs by integrating investment management with property management and AI tools.

Pros

Pros- AppFolio offers a fully functional investor mobile app.

- AI & automation features reduce manual tasks, such as email Smart Compose and auto-populating investment details from the PPM.

- The Org Chart automatically maps investor hierarchies, reducing the need for extensive legal and financial oversight.

- Integrates directly with its property management software, enabling firms to track financials and sync distributions and contributions with their general ledger.

Cons

Cons- AppFolio does not offer built-in investor accreditation services. However, they do support 3rd party accreditation services.

- Some advanced tools, like AI-powered Alpha asset management, require an add-on purchase.

Pros Explained

AppFolio offers a fully functional investor mobile app: AppFolio stands out as one of the only platforms offering a dedicated mobile app for investors. Unlike competitors that rely solely on web-based portals, AppFolio’s mobile-first approach ensures investors can seamlessly access their portfolios, review distributions, sign documents, and initiate capital contributions directly from their smartphones or tablets. This mobile accessibility enhances investor engagement, providing a frictionless, on-the-go experience.

AI & automation features reduce manual tasks: AppFolio leverages AI and automation to streamline investment management, significantly reducing manual processes. Features like Smart Compose use AI to generate investor communications, saving sponsors hours of drafting time. Additionally, the platform can auto-populate investment details from the PPM, eliminating the need for manual data entry and reducing errors. These automation capabilities enable firms to operate more efficiently while ensuring investor communications and documentation accuracy.

The Org Chart automatically maps investor hierarchies: Managing complex investment structures can be challenging. However, AppFolio’s Org Chart simplifies this process by automatically mapping investor hierarchies and capital structures. This feature eliminates the need for cumbersome spreadsheets or external legal oversight by visually displaying fund structures, ownership breakdowns, and multi-layered entities. Whether managing a simple syndication or a multi-tiered fund with multiple investment vehicles, sponsors can easily track investor relationships and optimize distribution flows with complete transparency.

Integrates directly with its property management software: One of Appfolio’s key differentiators is its direct integration with AppFolio Property Manager. This allows real estate firms to track financials, sync distributions and contributions, and manage investment accounting in a single system. Unlike other investment management platforms that require third-party integrations, AppFolio’s built-in general ledger functionality ensures that fund contributions and investor payouts automatically reconcile with property-level accounting. This end-to-end integration minimizes errors, streamlines reporting, and provides a unified financial view across investment and property management operations.

Cons Explained

AppFolio does not offer built-in investor accreditation services. While AppFolio offers tools to track investor accreditation, it does not provide a built-in accreditation verification service. Instead, sponsors must rely on external providers to handle compliance requirements.

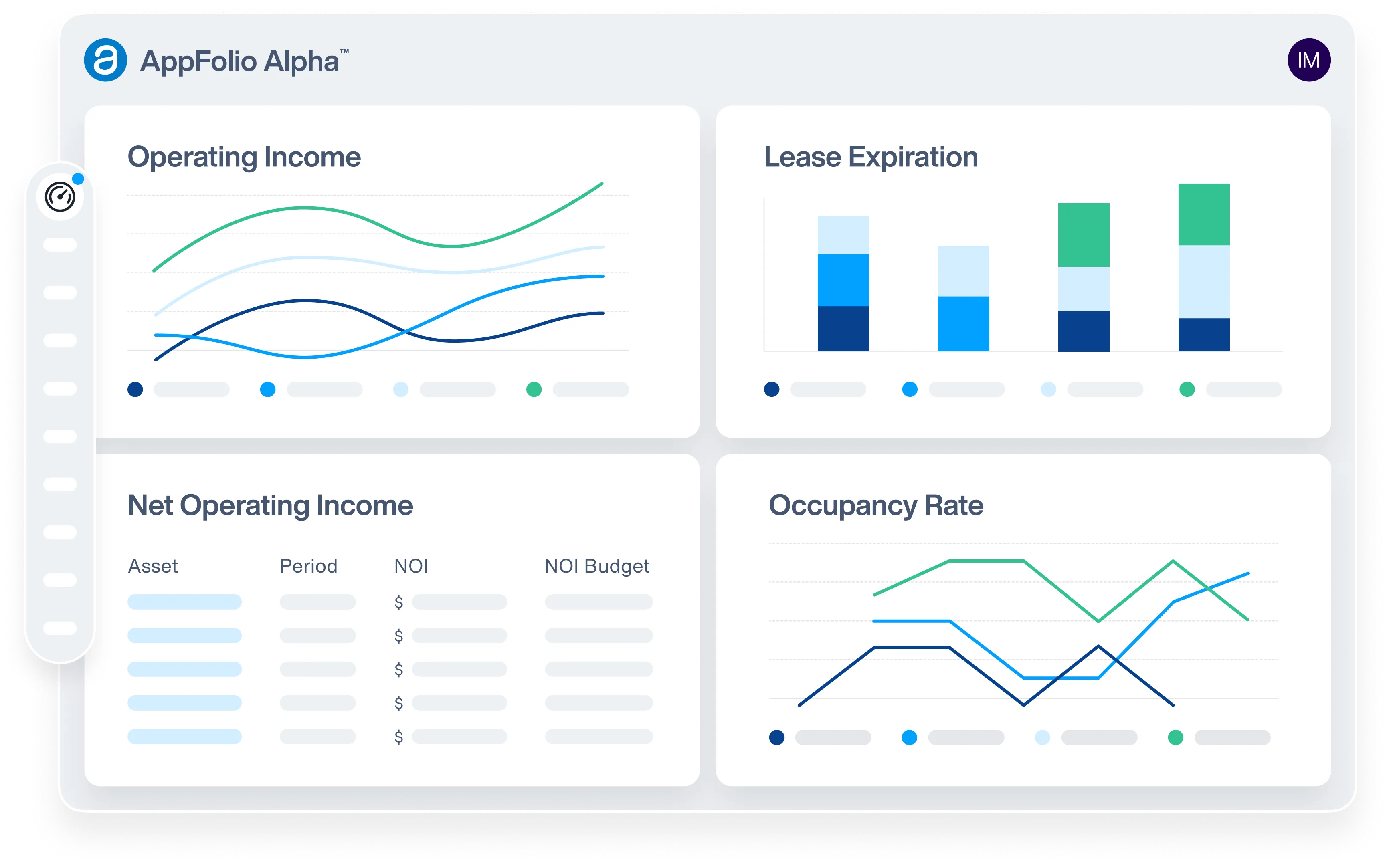

Some advanced tools, like Alpha asset management, require an add-on purchase. Although AppFolio Investment Manager offers a robust feature set, some of its most powerful tools, such as the Alpha Asset Management Platform, are only paid add-ons.

Appfolio Investment Manager Key Features

AppFolio Investment Manager offers a comprehensive suite of tools for CRE firms to effectively manage their investments. Key features include:

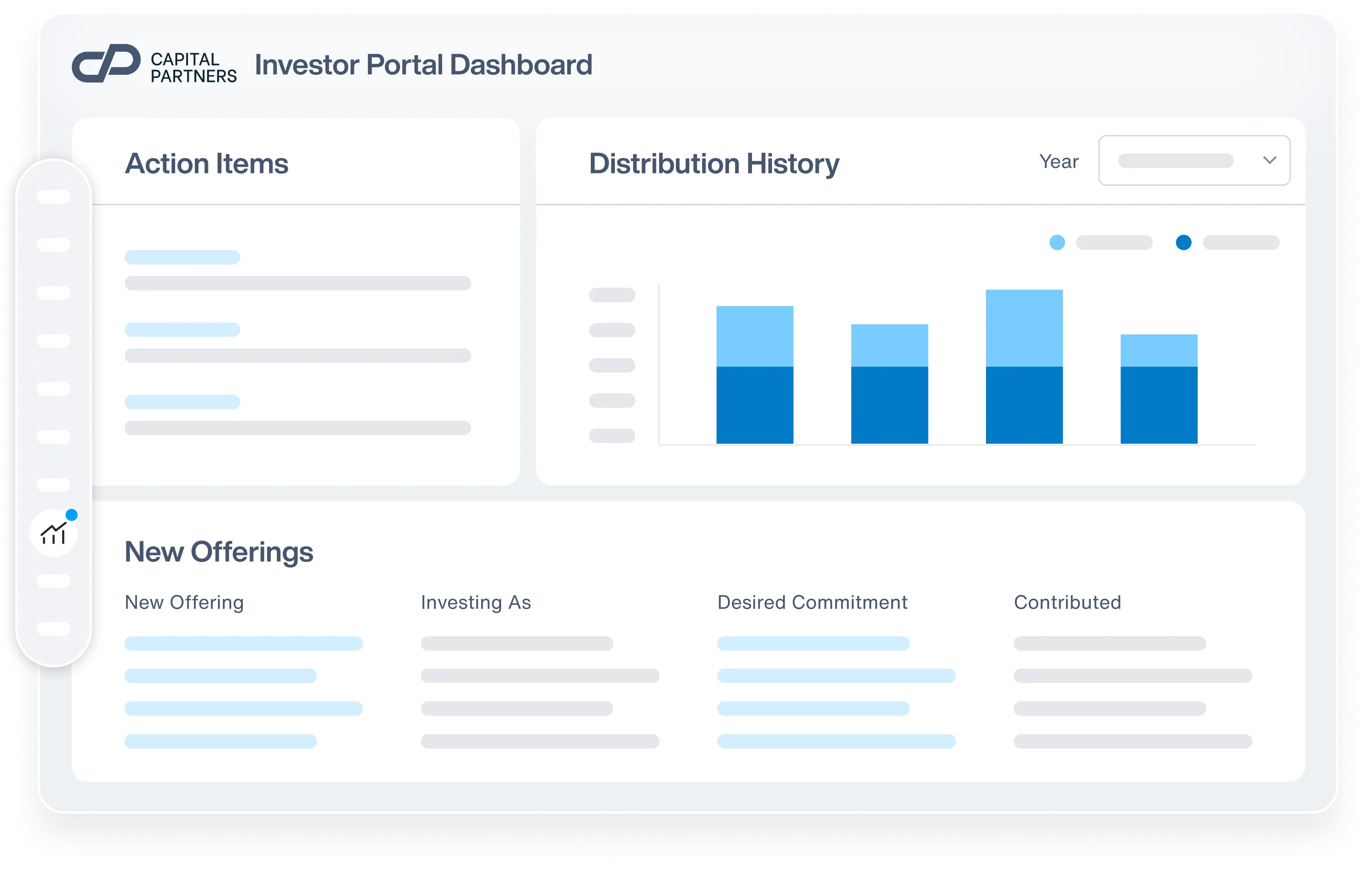

Investor Portal

AppFolio’s Investor Portal is designed to provide a frictionless experience for investors, offering a fully branded, mobile-optimized interface that ensures ease of use with minimal learning curves. Investors can seamlessly track their portfolios, view distributions, access financial reports, and complete capital calls directly from their smartphones or tablets. The portal dynamically adapts to each investor’s status, displaying relevant info such as new investment opportunities, outstanding action items, and transaction history. With built-in ACH payment processing, investors can contribute capital and receive distributions securely – directly from their mobile devices. This intuitive experience enhances investor engagement and reduces the administrative burden on sponsors.

Fundraising & CRM

Raising capital is simplified through AppFolio’s intelligent fundraising and CRM tools, which support various investment structures, including 506b, 506c, and Reg A offerings. Sponsors can create customizable offering pages with detailed investment data, multimedia content, and key performance metrics, ensuring an engaging and professional presentation. Integrated with a robust CRM, the system enables automated investor outreach, smart email composition, and real-time analytics on investor activity. Sponsors can optimize their capital-raising strategies by tracking investor engagement, time spent on offering pages, and fundraising progress. Additionally, investor segmentation, tagging, and group management features allow sponsors to personalize communications and efficiently manage relationships with high-net-worth individuals, family offices, and institutional investors.

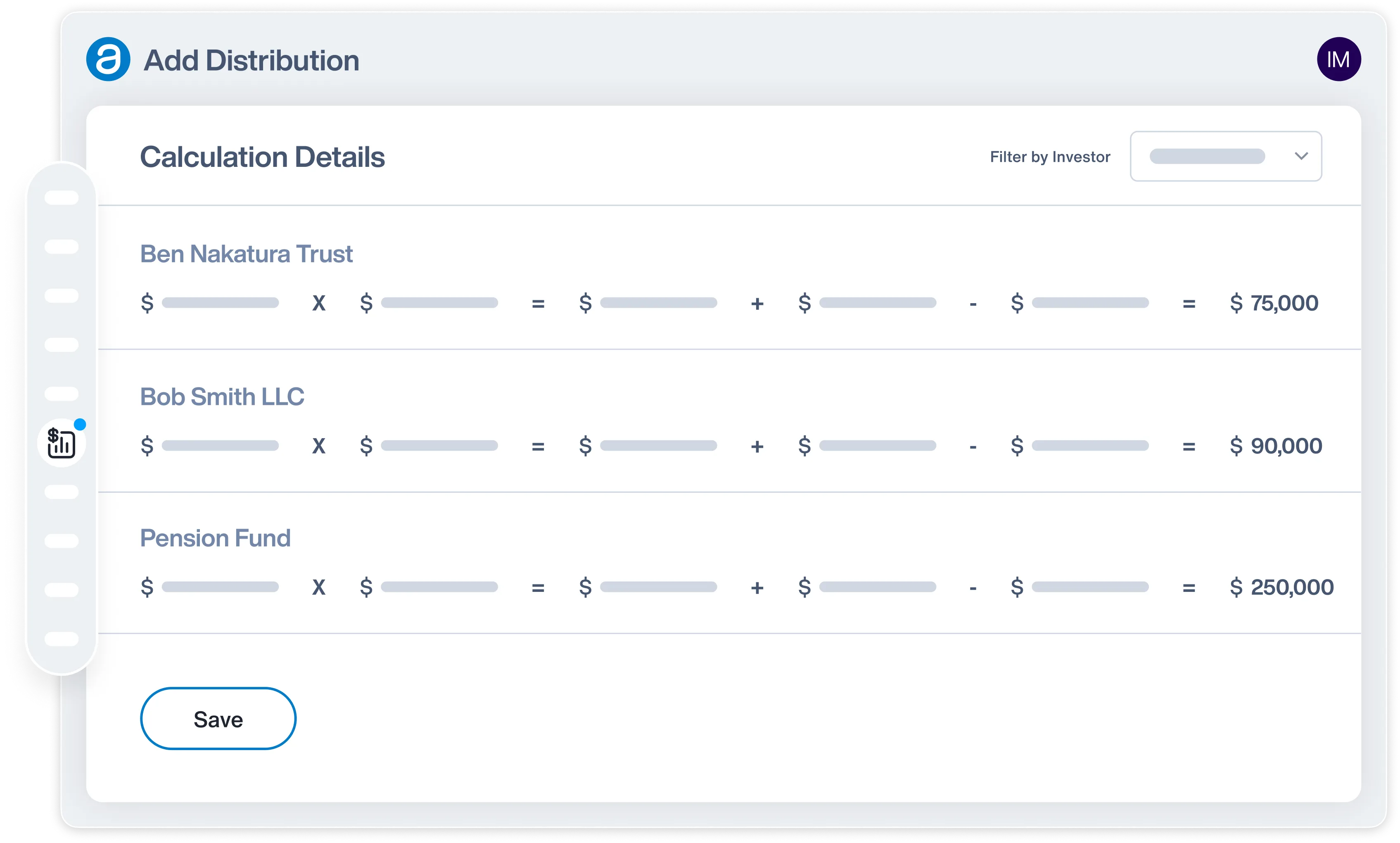

Distribution Automation

Managing complex ownership structures is effortless with AppFolio’s automated cap table and waterfall management tools. The platform generates visual org charts that dynamically map multi-tiered investment structures, including syndications, funds, and 1031 exchanges. The advanced waterfall tool simplifies distribution calculations, accommodating preferred returns, promotes, and tiered profit splits with the ability to audit the calculations. Users can automate fund flow calculations, ensuring accurate investor payouts across complex deal structures. With transparent, downloadable audit reports, sponsors and investors can easily verify how distributions were calculated, fostering trust and reducing the need for cumbersome spreadsheet tracking.

Alpha Asset Management

AppFolio Alpha™ is an AI-powered asset management platform that centralizes and analyzes data from multiple property management systems, providing real-time insights into asset performance. By leveraging AI to aggregate, normalize, and visualize financial data, Alpha enables firms to track NOI, lease expirations, LTV ratios, revenue trends, and operating expenses more rapidly and accurately than by human calculations alone. Its interactive dashboards compare actual performance against budgets and pro forma models, allowing for data-driven decision-making and proactive asset management. Additionally, Alpha enhances investor transparency by automatically generating performance reports within the Investor Portal. Available as an add-on, Alpha helps real estate firms optimize portfolios and improve financial oversight.

Property Management & Accounting Integration

A key differentiator of AppFolio Investment Manager is its seamless integration with the Appfolio Property Manager platform, creating a unified system for investment firms. The platform’s integrated General Ledger automates fund contributions, distributions, and accounting reconciliations, eliminating the need for manual bookkeeping. Sponsors using AppFolio Property Manager can access real-time property-level financials, lease data, and tenant information with a single click. Automated document management further simplifies compliance, allowing sponsors and investors to securely access K-1s, tax filings, and legal agreements. AppFolio provides a truly end-to-end solution for real estate firms by bridging the gap between investment management and property operations.

Financial-Grade Security

Recognizing the sensitivity of financial data, AppFolio Investment Manager employs top-tier security measures, including SOC1 Type 2 and SOC2 Type 1 & 2 certifications, data encryption, and two-factor authentication. All data is stored in state-of-the-art data centers, ensuring robust protection against unauthorized access.

User Experience

AppFolio’s UI is intuitive, with minimal learning curves for investors accessing their portal. The dashboard adapts based on an investor’s status, showing relevant action items like signing documents or completing a capital call. The AI-powered workflows significantly reduce administrative work for GPs, making fundraising and reporting more efficient. However, the software’s depth may require initial training, especially for firms managing multi-layered funds.

Customer Support

Appfolio’s customer support is knowledgeable and responsive. Users are assigned dedicated customer care representatives to assist with onboarding and ongoing usage, contributing to a seamless experience. Appfolio also offers an AI chatbot that helps users or can connect users to a customer support specialist.

Pricing

AppFolio Investment Manager offers two pricing tiers:

- Premier: Offers advanced features such as full API access and custom fields; pricing is customized based on specific business needs.

- Core: Starting at $650/month, includes essential features like the Investor CRM, fundraising workflows, and the investor portal.

Competitors

Juniper Square

Juniper Square is one of the biggest real estate investment management platforms on the market today. Juniper Square is specifically designed for real estate investment managers to help streamline fundraising, investor reporting, and investment management processes. Juniper Square is used by a wide range of real estate firms, including private equity firms, developers, and fund managers.

SponsorCloud (formerly SyndicationPro)

SponsorCloud is a real estate syndication software company specifically focused on the needs of real estate syndication companies. The software helps sponsors raise capital and manage assets and includes a CRM, investor portal, fundraising automation, and ACH payments.

Agora

Agora is a comprehensive real estate investment management platform that helps companies raise capital, manage their investors, and streamline operations. Agora includes a customizable investor portal, CRM, fundraising tools, document management, investor reporting, and financial automation.

FAQs

AppFolio Investment Manager is a real estate investment management platform designed to help GPs streamline fundraising, investor relations, and portfolio management. The platform offers AI-powered automation, a mobile-friendly investor portal, and seamless integration with AppFolio’s property management software. This allows firms to track financials efficiently, manage capital contributions and distributions, and automate complex fund structures. With features like automated waterfall calculations, CRM tools, and investor engagement tracking, AppFolio Investment Manager is a comprehensive solution for CRE firms looking to scale and optimize their investment operations.

Appfolio Investment Manager is good for real estate investment firms of all sizes. It offers a white-label investment management platform for small firms and deep customization for sophisticated firms. Combined with property management and asset management, it offers true flexibility for any firm looking to have one solution for their entire asset lifecycle.

AppFolio Investment Manager offers two pricing tiers. The Core plan starts at $650/month and includes essential features like the Investor CRM, fundraising workflows, and the investor portal. The Premier Plan offers advanced features such as full API access and custom fields; pricing is customized based on specific business needs.

How We Evaluated Appfolio Investment Manager

When evaluating Appfolio, we examined several factors, including:

- Product and service offerings: We dug into the depth and breadth of Appfolio’s features, products, and services and what sets them apart in the industry.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make Appfolio stand out from its competitors.

- Ease of use: We examined how user-friendly Appfolio’s platform is, how intuitive the onboarding process can be, and how quickly a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated Appfolio’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined the pricing of Appfolio products and services and whether readily available pricing information is available on its website.

Summary of Appfolio Investment Manager Review

For CRE investment firms seeking a comprehensive, automation-driven solution, AppFolio Investment Manager delivers seamless integration, AI-powered efficiency, and investor-friendly workflows. Its white-labeled investor portal, automated waterfall distributions, and advanced CRM tools make it a standout choice for GPs managing even the most complex portfolios. While some advanced features require add-ons, the platform’s overall functionality reduces administrative burdens and enhances investor engagement. Whether scaling your investment firm or optimizing existing operations, AppFolio Investment Manager offers the tools needed to stay ahead in today’s competitive market.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!