CompStak Overview

CompStak is the first crowdsourced CRE database that collects verified comps from executed lease and sale transactions. Its crowdsourcing process is unique to the industry and differs from any other source of comps. Over 40K brokers, independent appraisers, and researchers submit their comps to CompStak through its Exchange platform in exchange for credits. Those credits can then be exchanged for access to specific comps needed to complete their current transactions.

CompStak gives users the most comprehensive view of an asset and the surrounding market and submarket by utilizing lease comps, sale comps, loan information, and market analytics. CompStak’s unique platform provides hard-to-find data points such as actuals for starting rents, free rent, TI amounts, rent increases, term, expiration dates, net effective rent, cap rates, net operating income, true buyer/seller, and more. CompStak covers over 3.4M properties in 105 markets encompassing the entire country.

Our Take On CompStak

Best for users seeking the most accurate lease and sales comp data

CompStak’s crowdsourced model makes it a top choice for CRE professionals looking for accurate lease and sale comps, especially in the office, retail, and industrial sectors. With frequently updated and highly accurate data, CompStak stands out as a go-to resource in an industry where data quality is crucial.

Pros

Pros- Verified lease and sales comp data from actual transactions, not estimates or listing figures

- Data from an extensive network of over 40K brokers, researchers, and appraisers

- Unique data validation process that ensures a high degree of accuracy

- Advanced market analytics tools for custom trend analyses across submarkets and asset types

- Easy-to-use interface with 60+ search filters, customizable lists, and exportable data

- Powerful AI tools for instant insights and predictive analytics

Cons

Cons- Limited multifamily data

- No property owner contact info

Pros Explained

The most accurate, verified lease and sales comp data: CompStak captures actual transaction data directly from executed leases and sales, including verified starting rents, rent escalations, concessions, and net effective rent. Unlike other platforms that rely on estimates or listings, CompStak provides highly accurate, on-the-ground data from brokers, appraisers, and researchers, enabling better decisions based on actual lease and sales transactions rather than approximations.

Data from an extensive network of over 40K brokers, appraisers, and researchers: CompStak’s crowdsourced model is distinct in the industry. Its contributors earn credits to access data by submitting their comps, creating a dynamic exchange of up-to-date CRE data. This extensive network ensures broad, diverse data coverage across markets and submarkets, giving users access to comprehensive and frequently updated lease and sales comps.

Unique data validation process to ensure accuracy: CompStak has a rigorous data validation process. It starts by sourcing data from its trusted network of brokers, appraisers, and researchers and sending that data through AI algorithms to flag suspicious data and improve quality. Next, the data is personally reviewed and cross-verified by their team of commercial real estate analysts. Finally, CompStak’s community feedback system allows CompStak members to update comps with additional information to continually improve the data in the CompStak system. CompStak’s verification ensures that all data submitted meet high standards, creating a trusted data source that clients can use for underwriting, valuation, and competitive analysis.

Advanced market analytics tools: CompStak’s analytics tools, including Map Analytics, its Data Visualization tool, Chartbuilder, its Data Aggregation tool, and Market Dashboard, allow users to track market trends, visualize rent growth, and analyze lease terms across various submarkets and asset types over time. These tools support in-depth research with options to filter by property type, lease size, location, and more, making them powerful resources for identifying trends and creating custom market reports.

Easy-to-use interface: CompStak’s user-friendly platform features over 60 search filters, allowing users to refine results based on specific criteria such as lease type, transaction type, transaction size, and building class. Users can customize lists, export data, and even set notifications for new data relevant to saved searches, making the platform efficient for routine analysis and reporting.

Powerful AI tools for instant insights and predictive analytics: CompStak AI gives users access to advanced tools like CompScout, Rent Predictor, and AI-generated market summaries, enabling faster research, better underwriting, and data-backed decision-making. By layering AI on top of CompStak’s verified comp database, users can instantly surface trends, generate analyses, and model rent outcomes with far greater accuracy than traditional manual methods.

Cons Explained

Limited multifamily data: While CompStak excels with office, retail, and industrial data, complete multifamily income insights require a RealPage subscription.

No property owner contact info: Users looking for a tool that gives property owner contact information for prospecting purposes may find this lacking compared to other platforms.

CompStak Key Features

CompStak offers robust features that allow users access to accurate CRE data and insights.

Lease Comp Data

CompStak’s lease comp data offers insights into lease transactions with detailed, verified data points such as starting rent, rent escalations, tenant improvements, and net effective rent. CompStak collects this data from a network of 40K brokers, appraisers, and researchers who share recent lease deals in exchange for access to other data on the platform. This crowdsourced model allows users to access real-time, reliable lease data that reflects actual transaction details, not just listings. Users can filter by factors such as tenant, landlord, building class, and submarket, providing flexibility for market research, asset management, and underwriting. All data is exportable as well.

Sale Comp Data

CompStak’s sale comp data includes transaction details for property sales, providing verified information from public records and its Exchange network. Sale data complements lease data, allowing users to see a property’s leasing and ownership history, track building ownership, and obtain information on sale prices, buyers, and terms. This dual approach provides a unique context not typically available from public sources, such as financing terms and market-specific insights, which can assist in competitive analysis and valuation.

Property Data

CompStak’s property profiles include data on property attributes, recent transactions, tenant information, and more. CompStak offers a cohesive view of each property by integrating data from multiple sources, including active leases, average rents by property type, publicly recorded mortgages, and loan information, including CMBS loan data directly from a partnership with Trepp. The property profile helps users understand the full context of a property’s financial and physical status, which is especially useful for acquisitions, portfolio management, and property comparisons. To see detailed income data for multifamily, users will also need a separate subscription to RealPage Market Analytics, which they can purchase through CompStak.

CMBS Loan Data

CompStak One includes a limited snapshot of CMBS loan data in partnership with Trepp to give users a holistic view of CRE data. Within one consolidated experience, CompStak users can see important loan data like lender name, maturity dates, loan to value, and more. With loan information, users can evaluate property financials to uncover distressed opportunities and derive actionable insights from comps to analyze market health.

Chartbuilder

Chartbuilder is CompStak’s tool for creating custom, trend-based analyses at the market or submarket level. Users can aggregate and visualize data on metrics like rent growth, lease terms, and occupancy rates. With the flexibility to compare specific submarkets or broader regions, Chartbuilder enables in-depth analysis, such as tracking trends over time. It’s tailored for research teams who need to identify market trends or benchmark performance, making it ideal for generating insights that support investment strategy and forecasting.

Market Dashboard

The Market Dashboard provides an interactive overview of market-level metrics, including visualizations of trends, rent distributions, and tenant migration patterns across different property types. Users can drill down to submarkets, filter by date ranges, and adjust criteria like tenant industry and lease size. Additional features like heat maps and charts allow users to explore how different factors impact market conditions. The dashboard also includes market commentaries with references for some of the major markets in the country. The Market Dashboard is a helpful tool for asset managers and researchers who need customizable, visual insights into market dynamics for strategic planning and risk assessment.

Map Analytics

Map Analytics is CompStak’s tool for visualizing CRE data trends in a map. Its core functionality includes a Market Rent Heat Map to see where rents are high or low by asset class within a market, a Tenant Industry Map to visualize the concentration of tenant industries, a Space Type Map to see where various types of spaces tend to concentrate (like retail industrial space vs office, vs retail), and finally a dynamic Lease Expiration map that shows you lease expirations over time. This feature is particularly fun because it plays like a video and can actually let you see in which months or years an area of a market has a lot of leases rolling.

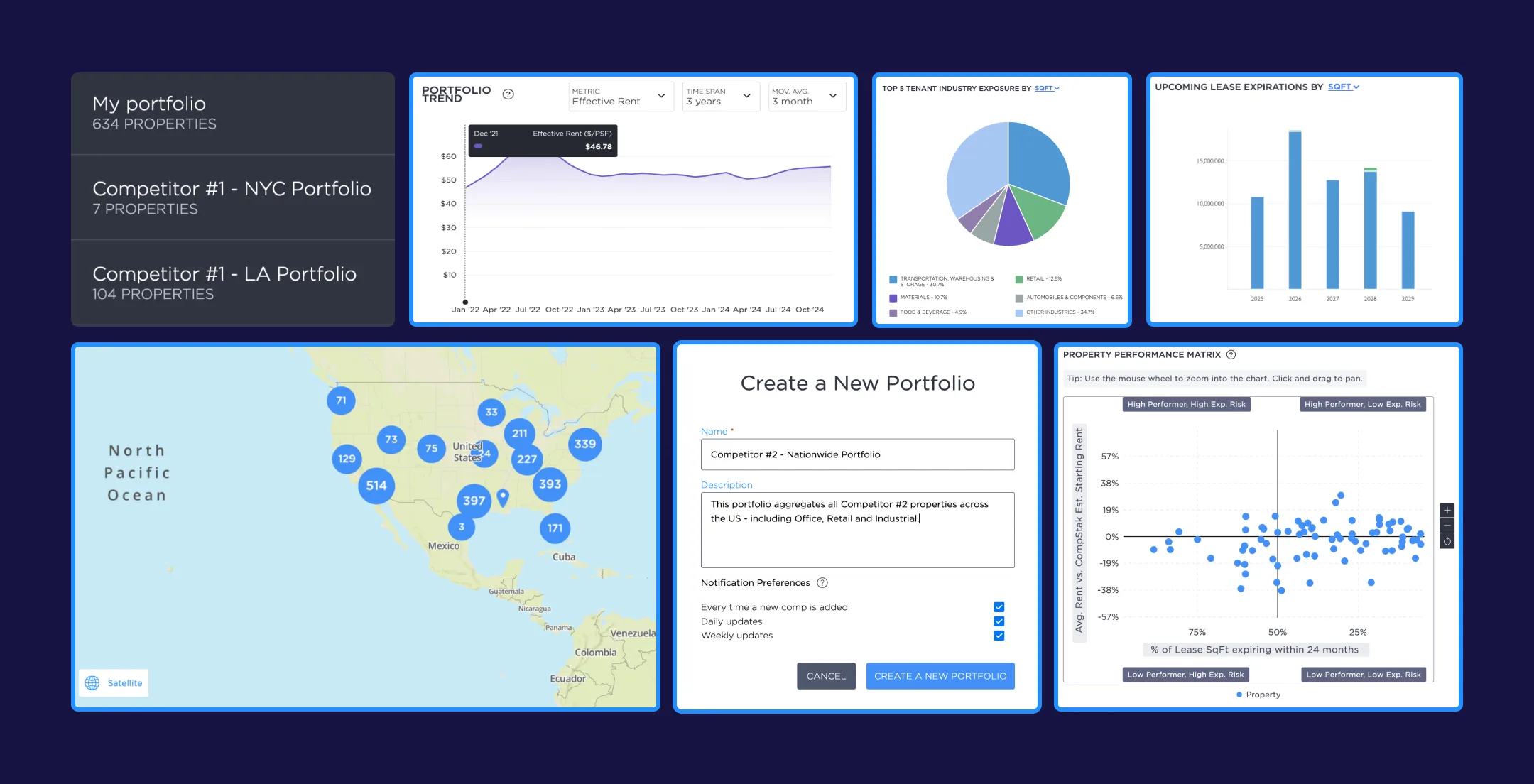

CompStak Portfolios

CompStak Portfolios is a powerful tool for CRE professionals to gain a competitive edge through comprehensive lease intelligence. Users can seamlessly monitor portfolio performance, evaluate financial health, and uncover growth opportunities by consolidating lease and property data across multiple assets. With key metrics such as average rent, tenant exposure, lease expirations, and market benchmarks, investors and asset managers can make informed, data-driven decisions. The platform enables proactive risk management by identifying potential threats and market fluctuations while offering comparative analysis to assess how a portfolio stacks up against competitors or broader market trends.

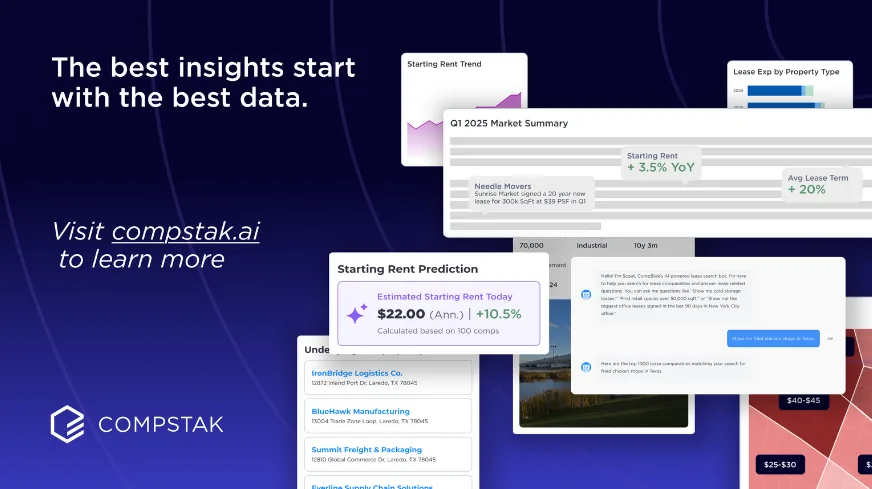

CompStak AI

CompStak AI is CompStak’s newest suite of tools designed to deliver instant insights and predictive analytics powered by the platform’s verified comp data. By combining robust datasets with advanced AI, users can streamline research workflows, surface trends faster, and generate market-ready analysis with minimal manual effort. CompStak AI supports underwriting, valuation, acquisitions, and research teams by providing faster access to data-backed conclusions.

CompScout

CompScout is CompStak’s AI-powered question engine that allows users to ask natural-language questions and instantly receive relevant answers sourced directly from CompStak’s dataset. Whether a user is searching rent trends for industrial outdoor storage in California or comps for quick-service restaurants in Texas, CompScout identifies the right data and delivers concise, actionable results.

Rent Predictor

Rent Predictor estimates rents and concessions for any space by incorporating variables such as building floor, square footage, property type, and competitive set. Predictions include supporting comps that validate the results, giving underwriting teams transparent justification behind each estimate. This tool helps users accelerate deal evaluation and improve accuracy in rent modeling.

AI Market Summary

AI Market Summary allows users to automatically generate full market analysis reports—complete with narrative summaries, charts, and recent deal references. These ready-to-use reports save researchers hours of time and can be used for internal reporting, client presentations, and investment memos.

Integration Options

CompStak AI integrates into CRE workflows at multiple levels:

CompStak One: Provides out-of-the-box access to all CompStak data and AI features, including Competitive Sets and Rent Predictor.

Modular Workflow Systems: Organizations can integrate Market, Property, and Space Insights into internal dashboards and LLM-based tools through APIs and MCPs.

APIs & Data Feeds: CompStak’s verified CRE data is available as integration-ready feeds to power proprietary valuation models, analytics platforms, and research systems.

Strategic Advisory: CompStak’s advisory team helps organizations develop data strategies and implement AI-driven workflows, ensuring teams turn raw data into meaningful business outcomes.

User Experience

CompStak’s interface is easy to use, allowing for a smooth user experience with multiple ways to filter and analyze data. Users can search by property address, nearby comps, or related properties. The platform also allows users to customize alerts on saved searches, providing real-time data updates. CompStak’s features and options enable users to access property and market data with a short learning curve.

Customer Support

CompStak offers multiple support options. General support is available through a website chatbot, email, and a shared helpdesk. At the same time, paid subscribers receive a customer success manager as the main point of contact to answer any questions. The customer success team is highly responsive, helping users optimize their experience through training and research assistance for advanced data needs.

Pricing

CompStak uses value-based pricing, which requires potential clients to discuss specific needs in a sales call before receiving a quote. While general pricing isn’t available online, CompStak provides flexibility, tailoring prices based on company size and data requirements. Most subscribers are on the CompStak One plan, which includes leasing, sales, CMBS data, and analytics. Access to the Exchange Platform for brokers and appraisers providing verified lease and sale data is free.

Competitors

CoStar

CoStar is a widely recognized and utilized CRE data company. It provides a comprehensive database of commercial properties and market intelligence to a broad spectrum of users, including investors, brokers, landlords, and tenants. The platform offers various services and tools that enable users to access detailed information about available properties, market trends, property analytics, comparables, lease and sale listings, and research reports.

While CoStar overlaps with CompStak on some leasing and sales data, it lacks comp data, which is CompStak’s bread and butter.

Real Capital Analytics (RCA)

MSCI’s Real Capital Analytics (RCA) is a CRE data and analytics provider that specializes in tracking and analyzing information related to property sales, capital trends, and market trends. RCA offers a comprehensive platform with data on property transactions, sales, financings, re-financings, foreclosures, development sites, and mortgage debt information.

While RCA offers strong sales comps and real estate intelligence, it lacks real, verified lease comp data.

FAQs

CompStak is a CRE data and analytics platform that provides verified lease and sales comp data, property information, and in-depth market research.

CompStak offers verified lease, sale, property, and loan data, including hard-to-find details such as starting rents, tenant improvements, cap rates, and more.

CompStak uses a three-tier verification system involving broker-submitted data through its Exchange network. This data is reviewed by machine learning algorithms, a statistical anomaly system, and an in-house research team.

CompStak’s platform is a tool for lenders, investors, brokers, owners/operators, appraisers, insurance providers, pension funds, real estate private equity, research teams, and anyone looking for the most accurate sale and lease comp data.

A limited trial is available upon request, with trial access typically granted for 24-48 hours.

Pricing is customized and available upon request based on user needs.

How We Evaluated CompStak

When evaluating CompStak, we examined several factors, including:

- Product offerings: We looked into the depth and breadth of data provided on CompStak, including what offerings set it apart from competitors.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make CompStak stand out from its competitors.

- Ease of use: We examined how user-friendly CompStak’s analytics platform is, how intuitive the onboarding process can be, and how quickly a new user will likely understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated CompStak’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined how CompStak products and services are priced and whether readily available pricing info is available on its website.

Summary of CompStak Review

CompStak is the leading lease and sale comps provider. The platform provides accurate property data sourced directly from brokers, researchers, and appraisers. The platform offers users an intuitive and data-rich experience across office, retail, and industrial. CRE professionals seeking accurate, up-to-date data will find CompStak a highly reliable resource in the competitive data provider landscape.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!