CRED iQ is a standout choice for small to medium-sized teams looking for cost-effective access to commercial real estate and CMBS data. It provides an easy-to-use interface, comprehensive and official loan data, true borrower and owner contact information, and a built-in valuation tool. CRED iQ’s precise and audited data includes all property types and geographies. CRE professionals leverage CRED iQ for a wide spectrum of use cases, such as uncovering acquisition and lending opportunities, market analysis, underwriting, & risk management.

CRED iQ Overview

Access to high-quality, timely data and the ability to analyze it effectively is crucial for CRE professionals to make informed decisions. That’s where CRED iQ comes in. Founded in 2020, CRED iQ is a commercial real estate data, analytics, and valuation platform powered by the full universe of CMBS & Agency loan and property data. CRED iQ is used to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. CRED iQ offers a full suite of CRE tools, including valuation modeling software and ownership contact data.

The data platform is powered by over $2 trillion in transactions and data covering every market and property type. Subscribers can access a comprehensive data set of distressed and non-distressed assets with owner contact details. Users can easily build a targeted list of properties and pinpoint value-add, off-market opportunities, expiring leases, and maturing loans. Refreshed monthly, key data points such as current loan balances, origination and maturity dates, lease expirations, servicer commentary, and borrower contact details make CRED iQ a one-stop-shop for CRE professionals.

Our Take On CRED IQ

CRED IQ

Best in CRE Databases and Sources for Investors

CRED iQ was created to make accurate commercial real estate data available to the wider commercial real estate finance community. CRED iQ can be described as the Zillow for commercial real estate, where users can understand important loan, property, ownership, and valuation information for all commercial properties across the U.S. The powerful search and filter capabilities return valuable data with a few clicks, whereas the learning curve for competing products is much longer and may involve substantial training. CRED iQ identifies valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Additionally, anyone analyzing real estate market trends and conducting market research can leverage CRED iQ’s data and analytics to gain insights into maturing loans, expiring leases, distressed properties, and valuation changes.

Pros

Pros- The platform is intuitive and easy to learn, with very minimal training needed in order to be effective.

- Users get access to the names, emails, and phone numbers of the real person behind each property without having to dig through layers of LLCs.

- The built-in valuation tool allows users to quickly and easily value a property without the need for complicated spreadsheets.

- A subscription gives access to all data within the platform rather than paying by geography or property type.

Cons

Cons- CREDiQ is still a young startup company with a short track record.

- Data points for non-securitized loans are not as robust.

Pros Explained

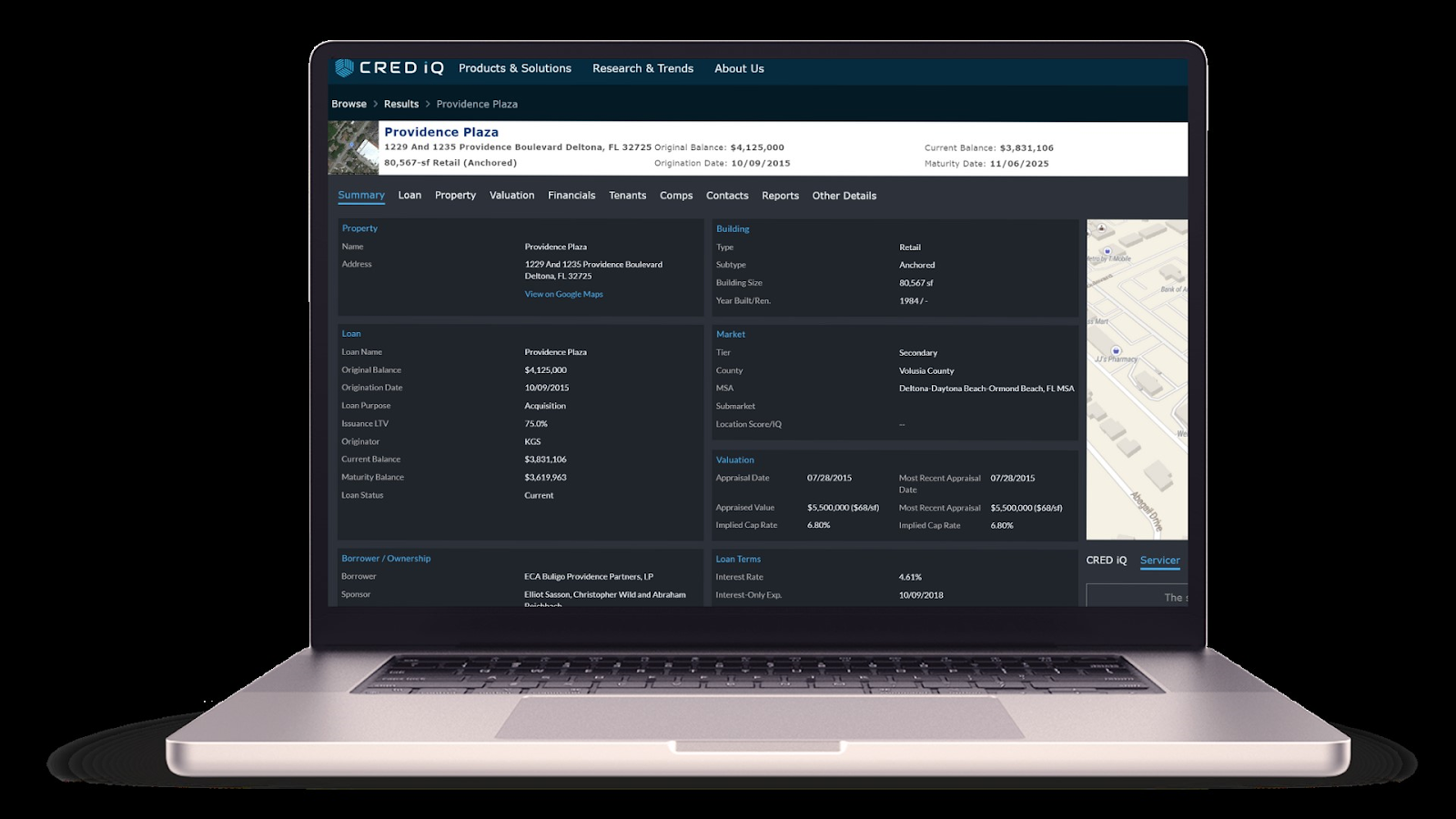

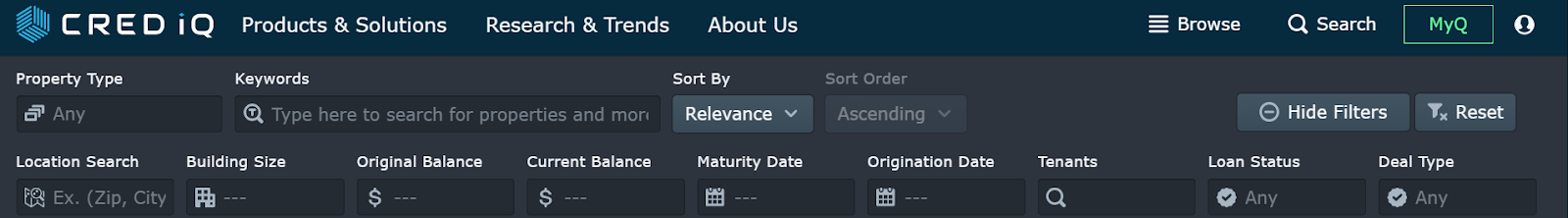

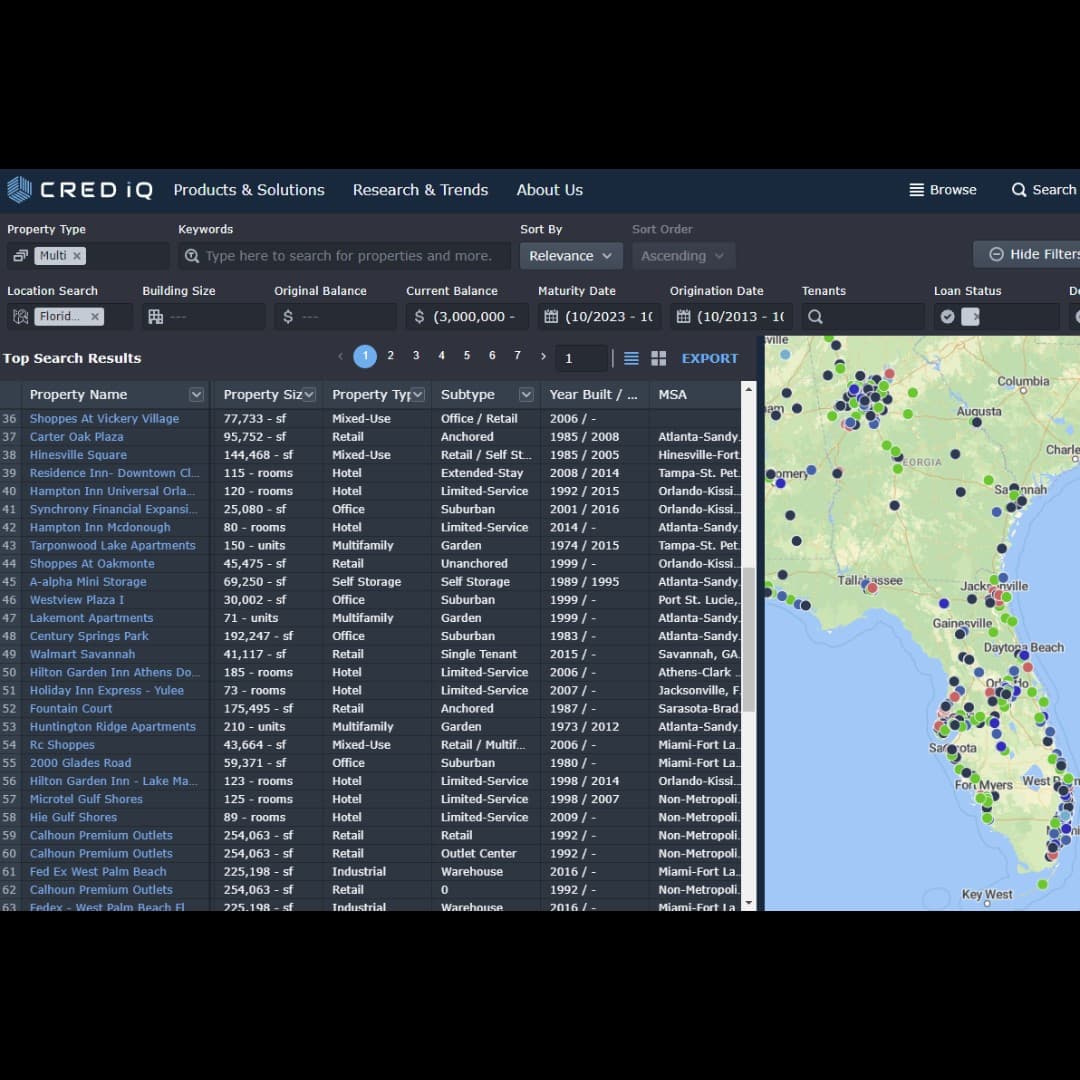

Easy-to-use interface: CRED iQ’s data platform is intuitive and easy to navigate. The layout is clean and simple, which makes it very easy to use. Working with so much data can be daunting, but CRED iQ makes it easy to filter and narrow your search. There are multiple options to filter, including property type, location, building size, loan balance, maturity date, origination date, loan status, and more. You can also search by scrolling and zooming on the map on the search screen.

Advanced borrower and owner contact information: One thing that stands out among the competition is that CRED iQ has invested heavily in having the market’s most advanced borrower and owner contact information. They offer over 90% coverage of true borrower and ownership contact details. The data goes beyond layers of entities to get to the real people behind each property. Users can access contact details, including names, addresses, phone numbers, and emails. Each property has up to two email addresses and four phone numbers for the registered property owner. This data is not easy to find on your own without spending hours digging through county records and multiple layers of entities. Accessing true borrower and ownership information is a game-changer and one of CRED iQ’s biggest differentiators.

Built-in valuation tool: Rather than using complicated spreadsheets, CRED iQ offers a built-in valuation tool to value a property quickly. You no longer need advanced modeling skills to get an accurate property valuation. CRED iQ introduces a groundbreaking tool named MyQ, which allows users to calculate property valuations in minutes. This streamlined and interactive discounted cash flow analysis tool is invaluable for investors and appraisers. MyQ’s unique comp rating engine, income and expense assumptions, and calibration options are what sets it apart. It simplifies a complex process, making property valuation accessible to a broader audience.

Subscribers get access to all data: Some providers charge by geography, property type, etc, but a subscription to CRED iQ includes access to all data, including but not limited to the following:

- Full Universe of Loans (CMBS, CRE CLO, SASB, and all Agency/GSE)

- Loan Data (Maturity dates, balances, loan terms, etc.)

- Building Data (Property type, subtype, size, year built)

- Borrowers, Owners & Lenders Names, Emails, Phone Numbers

- Detailed Income & Expense Financial Data

- Valuation software and appraised values

- Default Data from 1995 to the Present Day

Cons Explained

Short company track record: CRED iQ was founded in May 2020, so it’s been in operation for over three years, making it a very young, growing company. However, the team has a combined 30+ years of experience, and founder & CEO Michael Haas has over 15 years of CRE, CMBS & valuation experience. His previous gigs include overhauling Morningstar’s CMBS analytics & valuation platforms, co-founding Kroll’s first subscription business for CMBS investors, and launching Kroll’s first ratings software.

Chief Commercial Officer and industry veteran Chris Aronson’s experience includes serving EDR as CEO, where he helped develop CRE workflow software that served over 1,200 banks. The CRED iQ team comprises 15 full-time employees and is actively hiring software engineers, CRE analysts, and business development reps. While CRED iQ’s tenure is relatively short, its impressive list of prestigious clients and industry publications validates both the quality and depth of its capabilities.

Data is limited for non-securitized assets: Within the securitized universe (CMBS, SASB/SBLL, CRE CLO, Freddie Mac, Fannie Mae, Ginnie Mae), CRED iQ has 100% coverage of the properties and loans. However, the current CRED iQ offerings are limited mainly to the securitized universe. The Securitized and Agency markets represent roughly 34% of all CRE loans. CRED iQ covers 100% of properties and loans within those markets.

Loan data is limited for non-securitized assets: Within the securitized universe (CMBS, SASB/SBLL, CRE CLO, Freddie Mac, Fannie Mae, Ginnie Mae), CRED iQ has 100% coverage of the properties and loans. However, the current CRED iQ offerings are limited mainly to the securitized universe. The Securitized and Agency markets represent roughly 34% of all CRE loans. CRED iQ covers 100% of properties and loans within those markets.

CRED iQ Product Offerings

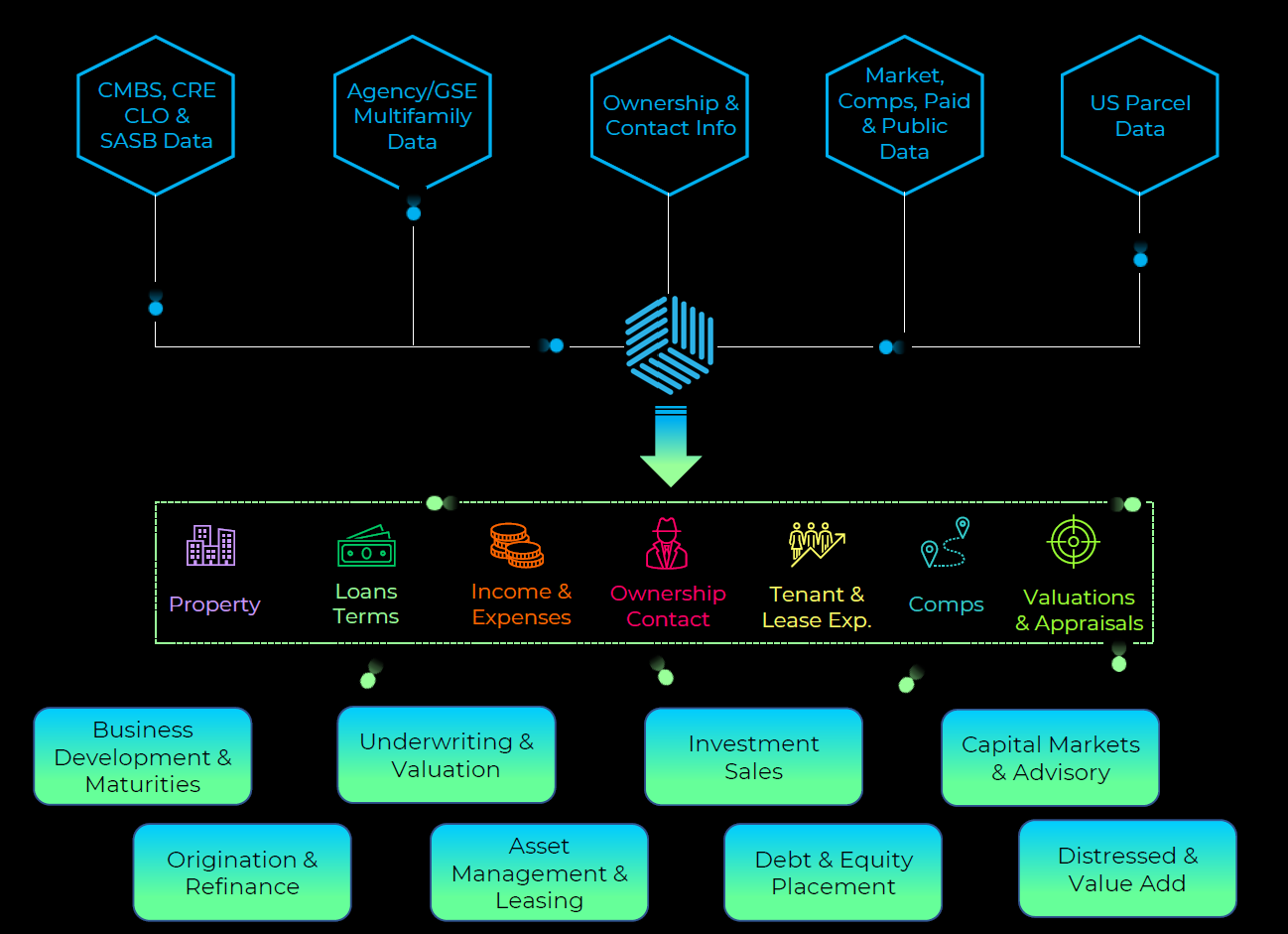

CRED iQ offers a range of products and solutions tailored to meet the diverse needs of commercial real estate professionals. Their offerings can be categorized into three main buckets:

Data and Analytics

CRED iQ’s flagship product is its data and analytics platform. CRED iQ provides access to an extensive database containing over $2.0T of CRE data. This includes loan data, property data, parcel information, tenant details, income and expenses, valuations, and borrower information across various market segments and asset classes. The coverage spans the full spectrum of CRE, including CMBS, SASB, CLO, and GSE Agency (Freddie Mac, Fannie Mae, Ginnie Mae, FHA/HUD) loan data. This data treasure trove is a valuable resource for investors, lenders, and brokers to make well-informed decisions.

The ability to analyze data in real-time is a crucial aspect of any CRE professional’s toolkit. CRED iQ empowers its users to stay ahead of the market by offering tools to identify opportunities, monitor maturing loans, track expiring leases, identify distressed situations, and detect valuation changes. The analytics provided by CRED iQ are a game-changer for investors and property managers who want to make data-driven decisions.

In addition to access to thousands of properties, subscribers can also use the built-in valuation tool to quickly and accurately value a property. MyQ, the interactive discounted cash flow analysis tool, is a key differentiator among its competitors. The software enables CRED iQ subscribers to value any commercial property using a streamlined discounted cash flow analysis or direct capitalization approach. Unlike any tool in the market today, MyQ pre-fills a property’s actual in-place financial data and utilizes it as the foundation for the valuation assumptions.

Financial and appraisal comps well support assumptions for up to 25 comparable properties. A user can change 20-30 key assumptions, including rent, expense, cap rate, and more. Each valuation assumption is fully interactive, allowing subscribers to adjust based on % of revenue, $ per size, or full dollar amounts. The valuation report can be exported to a PDF presentation, but at this time, it cannot be exported to Excel. This may be a feature in the future. CRED iQ’s valuation tool simplifies a complex process, making property valuation accessible to a wider audience.

Insights and Alerts

Many well-known news publications turn to CRED iQ as a trusted source. Data and insights from CRED iQ have been featured in The Wall Street Journal, Reuters, Bloomberg, GlobeSt, Commercial Observer, and more. Subscribers and non-subscribers can access CRED iQ’s News and Research directly on their website. The team puts together a monthly Delinquency Report outlining the market’s distress and other industry trends. The site also offers reports on market trends, sector-specific commentary, case studies, and more. While the research is available to anyone, only subscribers can access the underlying data supporting the reports.

All subscribers can also receive a daily alert with distressed properties at no additional cost. A subscriber can choose to opt into the Distress Alerts emails during the onboarding process. The distressed properties on the daily alert can be found within the CRED iQ database, but the daily report puts them at users’ fingertips.

CRED iQ also offers a weekly newsletter, CRED iQ Insights, for anyone in the CRE ecosystem. A members-only newsletter, Street CRED, is in the works.

Integrated 3rd Party/Client Data

CRED iQ offers the flexibility to incorporate user data directly into their analytics platform. They offer custom tech solutions so companies can integrate their data within the platform. CRED iQ can build custom data that integrates via API to CRMs like Salesforce, Hubspot, Zoho, and more.

This integration provides a multidimensional view and in-depth analysis for making strategic decisions. Alternatively, CRED iQ can enhance a company’s data with its unique insights, further improving the quality and comprehensiveness of data. CRED iQ has pre-built integrations with RCA (MSCI), Reis, Moody’s Analytics, Moody’s Economy, and Fitch. Additional integrations are planned for the future. This adaptability makes CRED iQ appealing to businesses seeking tailored data solutions.

User Experience

CRED iQ’s data platform is intuitive and easy to navigate. The layout is clean and simple, making it easy to learn. The intuitive search function gives many filter options to search for properties. You don’t need to be tech-savvy to use the platform.

Working with so much data can be daunting, but CRED iQ makes it easy to filter and narrow your search. While there aren’t any training materials on using the platform, they aren’t essential to learning the tool. It’s that easy to use. If training is needed, the team at CRED iQ will work with subscribers one-on-one to ensure they can use the platform to its full potential. CRED iQ also assigns each subscriber a dedicated customer success rep who can provide additional training and support.

The built-in valuation tool is also straightforward to use. You don’t need advanced financial modeling skills to generate a property valuation within a matter of minutes. While it would be nice to export the valuation to an Excel file (only PDF currently), that feature may come down the road.

Customer Support

CRED iQ has multiple ways to contact their support team. With the mantra, “data doesn’t sleep,” the team prides itself in its quick response times.

CRED iQ’s support portal and team are dedicated to assisting customers and ensuring they can leverage the platform to its full potential. While a support phone number isn’t available, the CRED iQ team can be contacted in a few ways. First, you can either email [email protected] or [email protected]. Next, the website offers a chatbot to submit support requests. The site also offers a support portal where users can pick from a list of options to make specific requests to the CRED iQ team, such as:

- Technical support

- Licensing and billing questions

- Product trial questions

- Report a bug

- Suggest a new feature and/or improvement

Finally, each subscriber receives a dedicated customer success rep to answer any questions. While the website doesn’t offer training materials or FAQs, the CRED iQ team is easily accessible and responsive to answer questions.

Pricing

Pricing is based on an organization’s size and the number of users requested. The Enterprise Subscription starts at $1,200/month and includes full access to every market and every property for up to 4 users. For smaller or larger organizations, CRED iQ offers customized programs to reconcile to team sizes. Finally, special discounts are offered for non-profits and universities.

Subscription plans are competitively priced and are found to be below that of CRED iQ’s competitors. To get pricing more specific to an organization’s needs, a potential user must contact the CRED iQ team here.

Anyone can create a free account to explore basic features such as every property type, basic property data, and basic loan data. A free trial can be requested directly from the CRED iQ team, which gives access to 100% of the features any paying subscriber receives. Trials are typically good for 48 hours.

Competitors

CRED iQ’s main competitors are Trepp, CoStar, and Reonomy.

Trepp, founded in 1979, provides data, technology solutions, and insights to the structured finance, commercial real estate, and banking markets. Trepp offers a suite of products for monitoring and analyzing both securitized and non-securitized commercial mortgages and properties, whole loan portfolios, and nationwide commercial mortgage financial statistics.

Trepp is CRED iQ’s #1 competitor. Compared to Trepp, CRED iQ is materially less expensive. CRED iQ is also much easier to learn and use. Trepp’s user interface is not intuitive and can take much longer to learn and be productive, while CRED iQ is intuitive from the start. Trepp also doesn’t pierce through LLC ownership to provide names and contact information for the real people behind property ownership, a key business development feature many other platforms provide, including CRED iQ.

CoStar is a widely recognized and utilized commercial real estate information company. It provides a comprehensive database of commercial properties and market intelligence to a broad spectrum of users, including investors, brokers, landlords, and tenants. The platform offers various services and tools that enable users to access detailed information about available properties, market trends, property analytics, comparables, lease and sale listings, and research reports.

CRED iQ is materially less expensive than CoStar. While CoStar is one of CRE’s most widely used platforms, it does not offer as much data on property loans as CRED iQ. Much of CoStar’s analytics come from its affiliate brands, including LoopNet, Showcase, Ten-X, Apartments.com, Apartment Finder, and Homesnap, making it the largest and most well-known commercial real estate database.

Reonomy is a commercial real estate data platform that provides comprehensive property information and insights to real estate professionals, investors, brokers, lenders, and other industry stakeholders. The platform aggregates vast data from various sources, including public records, tax assessments, transaction histories, and more, to offer detailed information about properties across the United States.

Compared to Reonomy, CRED iQ covers much more property data. CRED iQ covers 100% of all securitized and agency markets and will soon cover around 93% of all properties, including land and residential. Reonomy’s coverage is much more limited.

FAQs

CRED iQ is a comprehensive platform for commercial real estate information, analysis, and assessment, delivering practical insights to investors in CRE and capital markets. Users subscribe to access valuable prospects for leasing, lending, refinancing, distressed debt, and potential acquisitions.

Moreover, the platform provides a streamlined valuation tool applicable to all property types and geographies. The platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.

Within the securitized universe (CMBS, SASB/SBLL, CRE CLO, Freddie, Fannie, Ginnie), CRED iQ has 100% coverage of properties and loans in all asset classes.

As an official data provider, the data is provided directly by the principals, servicers, and trustees. Within the securitized markets, there are regulatory mandates for reporting, which the owners/borrowers must comply with.

Yes. Free trials, which are good for 48 hours, can be requested by emailing [email protected]. Additionally, anyone can create a free account to access basic features such as every property type, basic property data, and basic loan data.

CRED iQ identifies valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Lenders, brokers, investors, and appraisers will all find the CRED iQ platform valuable. Anyone analyzing real estate market trends and conducting market research can leverage CRED iQ’s data and analytics to gain insights into maturing loans, expiring leases, distressed properties, and valuation changes.

The Enterprise Subscription starts at $1,200/month and includes full access to every market and every property. For smaller organizations, CRED iQ offers customized programs to reconcile to team sizes. Finally, special discounts are offered for non-profits and universities.

How We Evaluated CRED iQ

When evaluating CRED iQ, we looked at several factors, including:

- Product offerings: We looked into the depth and breadth of data provided on CRED iQ, including what offerings set it apart from competitors.

- Pros and Cons: We weighed what potential customers should watch out for against the features they would find stand out amongst competitors.

- Ease of Use/Functionality: We tested how user-friendly and intuitive the CRED iQ platform is and how quickly a new user could understand its functionality.

- Customer Support: We evaluated CRED iQ’s support network for response time, training materials, and accessibility to customer service reps.

Pricing and transparency: We examined how CRED iQ’s products are priced and how readily available pricing information can be found.

Summary of CRED iQ Review

CRED iQ stands as a new force in the commercial real estate industry, offering a comprehensive suite of products that cater to the diverse needs of CRE professionals. Whether you are a property investor looking for opportunities, a lender evaluating risks, or a broker trying to connect buyers and sellers, CRED iQ’s offerings are designed to cater to your needs. The company’s commitment to providing accurate, up-to-date, and comprehensive data sets it apart in an industry where data quality is of utmost importance.

The platform’s strengths include an easy-to-use interface, advanced borrower and owner contact information, a built-in valuation tool, and access to all geographies and property types. The incorporation of MyQ, an interactive discounted cash flow valuation tool, simplifies property valuation and makes it accessible to a broader audience.

CRED iQ’s data and analytics platform, powered by over $2 trillion of CRE data, equips users to identify opportunities, track maturing loans, and monitor market dynamics while insights, alerts, and integration capabilities enhance its value as a data-driven decision-making tool. Despite concerns about their relatively short company track record, CRED iQ’s team possesses substantial collective experience.

Overall, CRED iQ is an exciting addition to the commercial real estate industry. CRED iQ’s emphasis on data accuracy and innovative tools positions it as a credible and valuable tool for the industry. Ultimately, CRED iQ shines in its data capabilities, making it the best CRE data analytics platform for navigating the complexities of CRE and ensuring accurate valuations and transparent ownership information.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any real estate investment. For any questions or assistance with these resources, feel free to contact [email protected]. We’re here to help!