Lev Overview

Lev is a digital platform for CRE financing. It connects borrowers or brokers with lenders through a combination of market-leading data, highly automated workflow tools, and a purpose-built CRM. The platform provides access to real-time data from over 4,000 lenders, helping users find optimal loan terms quickly and efficiently. Lev’s matching algorithm connects customers with thousands of potential lenders while offering tools to streamline workflows, such as automated follow-ups, placement tracking, and AI-generated deal books.

Our Take On Lev

Best for Sponsors and Financing Lenders looking to expand their networks and manage deals.

Lev stands out in the CRE financing landscape for its comprehensive lender data and intuitive and flexible software. Lev’s lender data is sourced, verified, and constantly updated through a combination of public records, lender submissions, and real-time insights from live deals. The platform streamlines the financing process, eliminating the need for time-consuming manual outreach. Lev’s AI-driven tools, such as its automated deal room creator and smart lender matching, offer a seamless experience from initial lender research through getting a signed term sheet. While not a low-cost solution, the quality of the software, data, and dedicated support you get makes Lev a worthwhile investment for large or growing CRE shops.

Pros

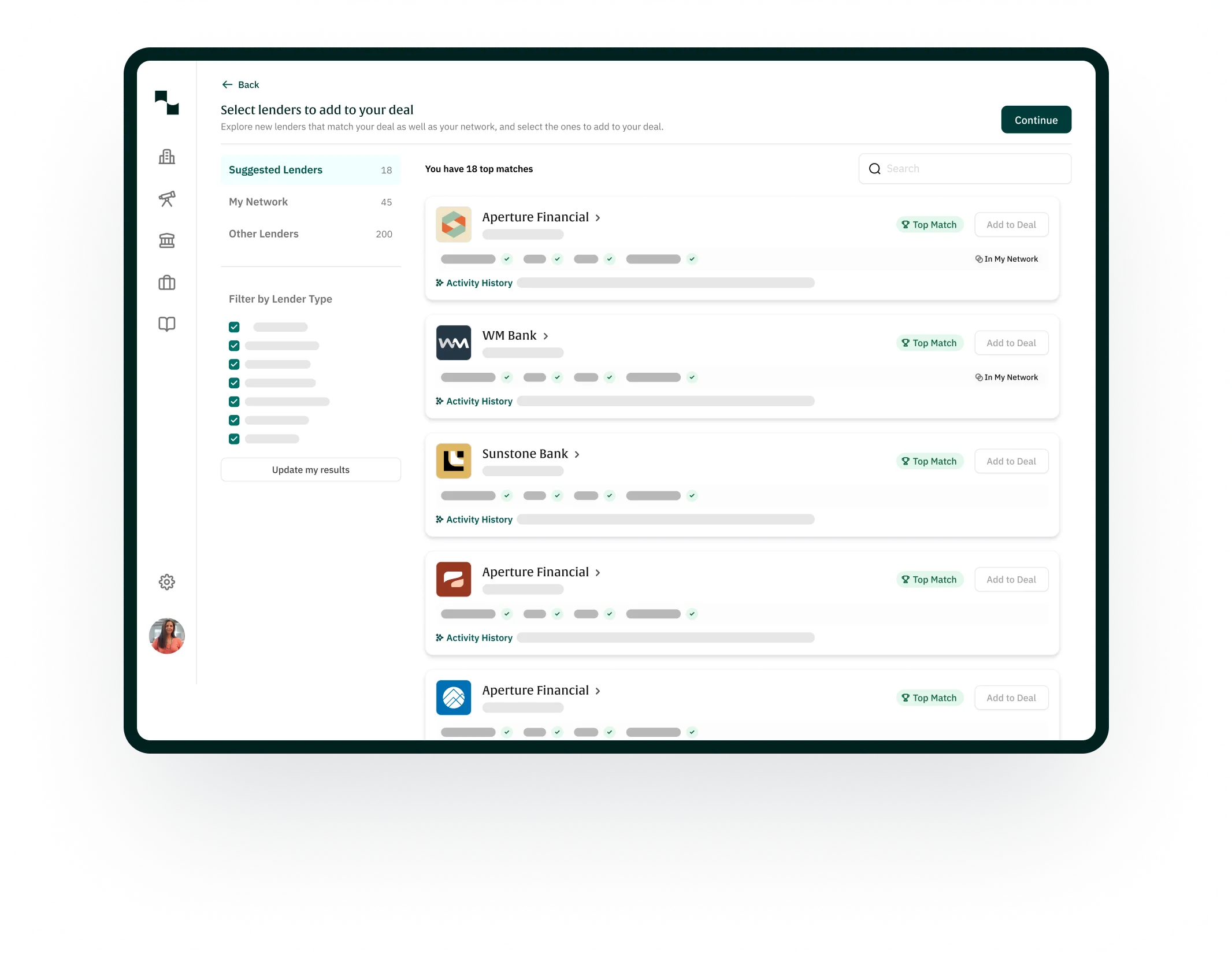

Pros- Provides access to real-time and historical data for over 4,000 lenders nationwide, including current programs and verified contacts across different lending divisions, letting users easily run deals in any geography or asset class.

- Offers comprehensive relationship management (CRM) capabilities built specifically for CRE.

- Provides time-saving AI tools, such as automated lender outreach, document creation, and follow-ups, that help significantly streamline traditional financing workflows.

- Very intuitive, fast, and user-friendly interface.

Cons

Cons- If you are a sponsor looking for a “do-it-for-me” or outsourced financing offering, you are probably better off hiring a broker to run the process.

- Potential learning curve for less tech-savvy users, although the company offers solid onboarding and ongoing account management support.

- Lev is a relatively young company with a short track record.

Pros Explained

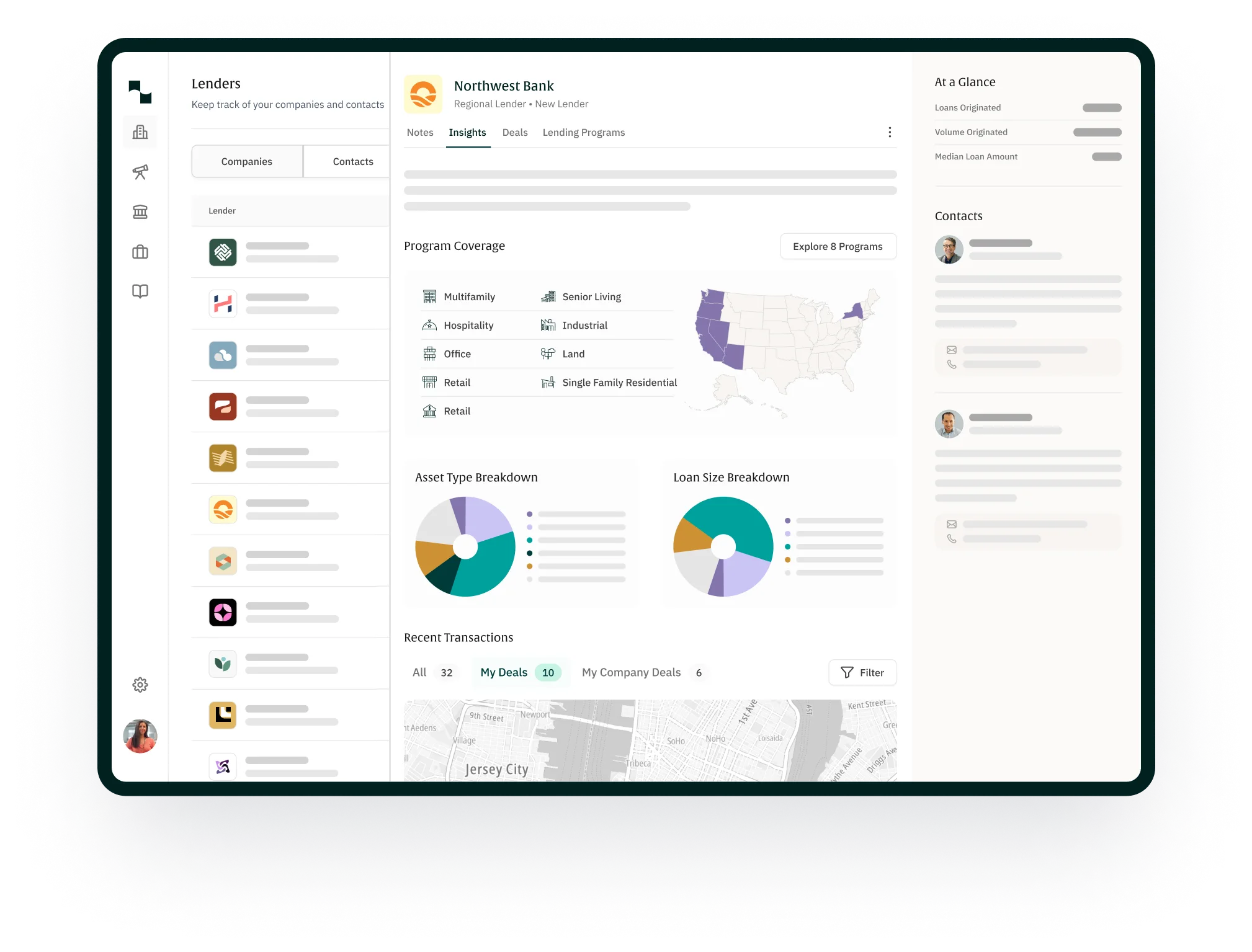

Provides real-time and historical data for over 4,000 lenders nationwide: Lev aggregates information from thousands of national and regional lenders, which includes traditional banks, debt funds, and life insurance companies, offering users a real-time snapshot of current lending programs and recent market terms. Users can run lender searches across multiple geographies and asset classes and receive immediate and comprehensive results. Users can see aggregated results and open profiles for each lender for more detailed information. In addition, the platform identifies the right contact to reach out to for each specific deal.

Offers comprehensive relationship management (CRM) capabilities built specifically for CRE: The platform helps users track and manage lender relationships by storing contact profiles, deal histories, and updates in a centralized hub. Users can easily add private notes to lender profiles. Lender records are automatically updated as new contacts, programs, or other lending preferences become available. Real-time status updates and automated reports make it easy to manage multiple deals simultaneously. Users can instantly download a report showing the status of a deal, a feature that will be particularly valuable for brokers looking to share updates with clients.

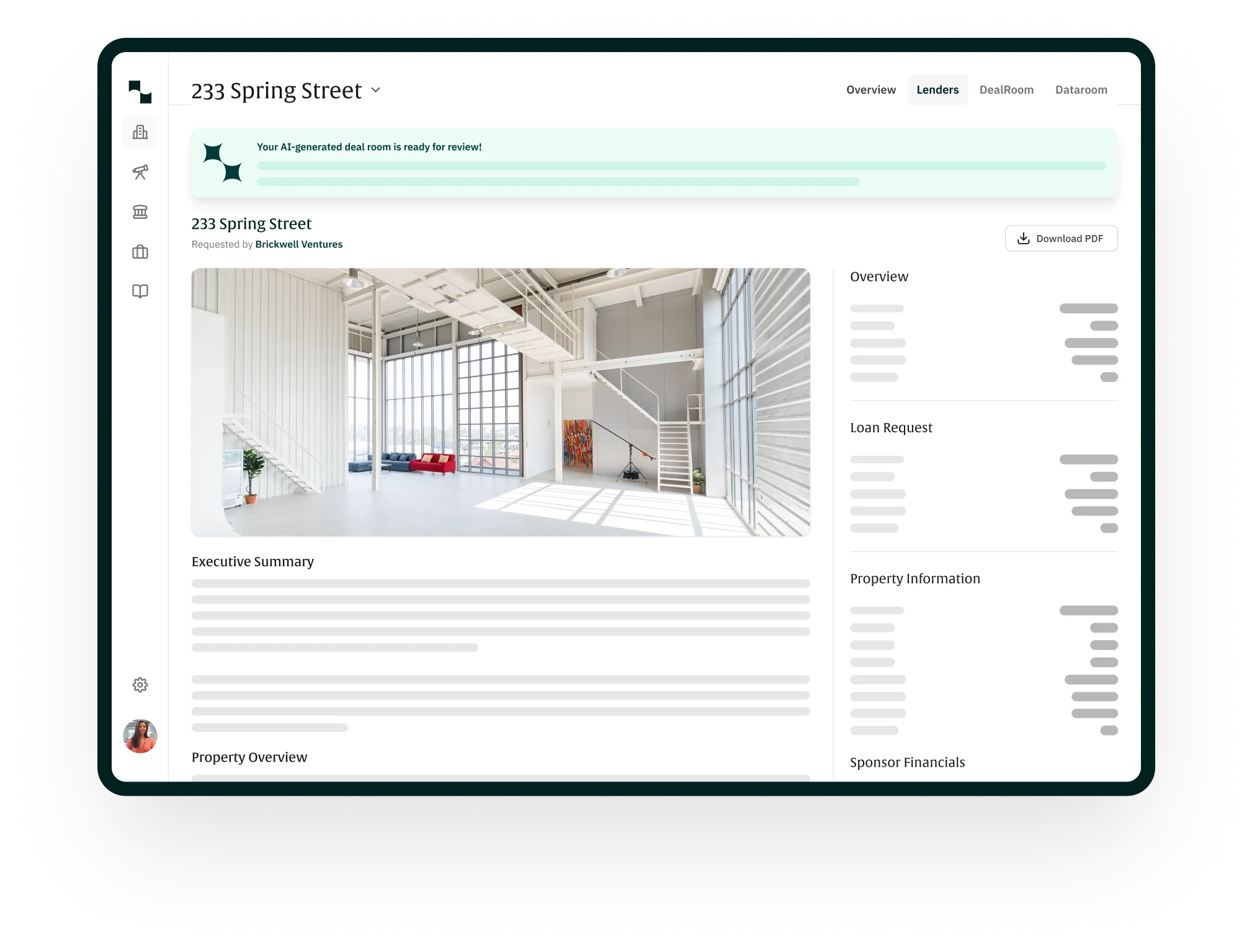

Provides time-saving AI tools, like automated workflows, document creation, and follow-ups: Lev automates much of the financing process, from generating professional deal books to sending automated follow-ups and reports, reducing manual tasks and ensuring deals move forward without delays. Notably, Lev’s Deal Room AI allows users to create polished marketing materials in as little as 5 minutes by uploading basic deal documents. Automated status tracking is also super easy for tracking each lender’s placement.

Very intuitive, fast, and user-friendly interface: Most users will find Lev’s features easy to use without much training or guidance. The platform’s functionality is intuitive, allowing users to navigate effortlessly and maximize productivity from the start.

Cons Explained

Self-serve interface: Some sponsors don’t have the bandwidth and/or expertise to run financing themselves or don’t see it as a core competency, so they always hire a financing broker. While the platform automates large parts of the process, manual work is still involved, which may not be for everyone.

Learning curve: Some less tech-savvy users may initially find the platform’s advanced AI features and comprehensive toolset overwhelming. However, subscribers are assigned an account manager to help with onboarding and provide deal support and ongoing strategic account advice.

Short company track record: Founded in 2019, Lev is a relatively young company in the CRE financing space. However, Lev has raised $100 million in venture capital funding and financed over $2 billion worth of deals in 2024 alone.

Lev Product Offerings

Lev offers tools for both sponsors and brokers to help simplify the CRE financing process. Some of Lev’s key features include:

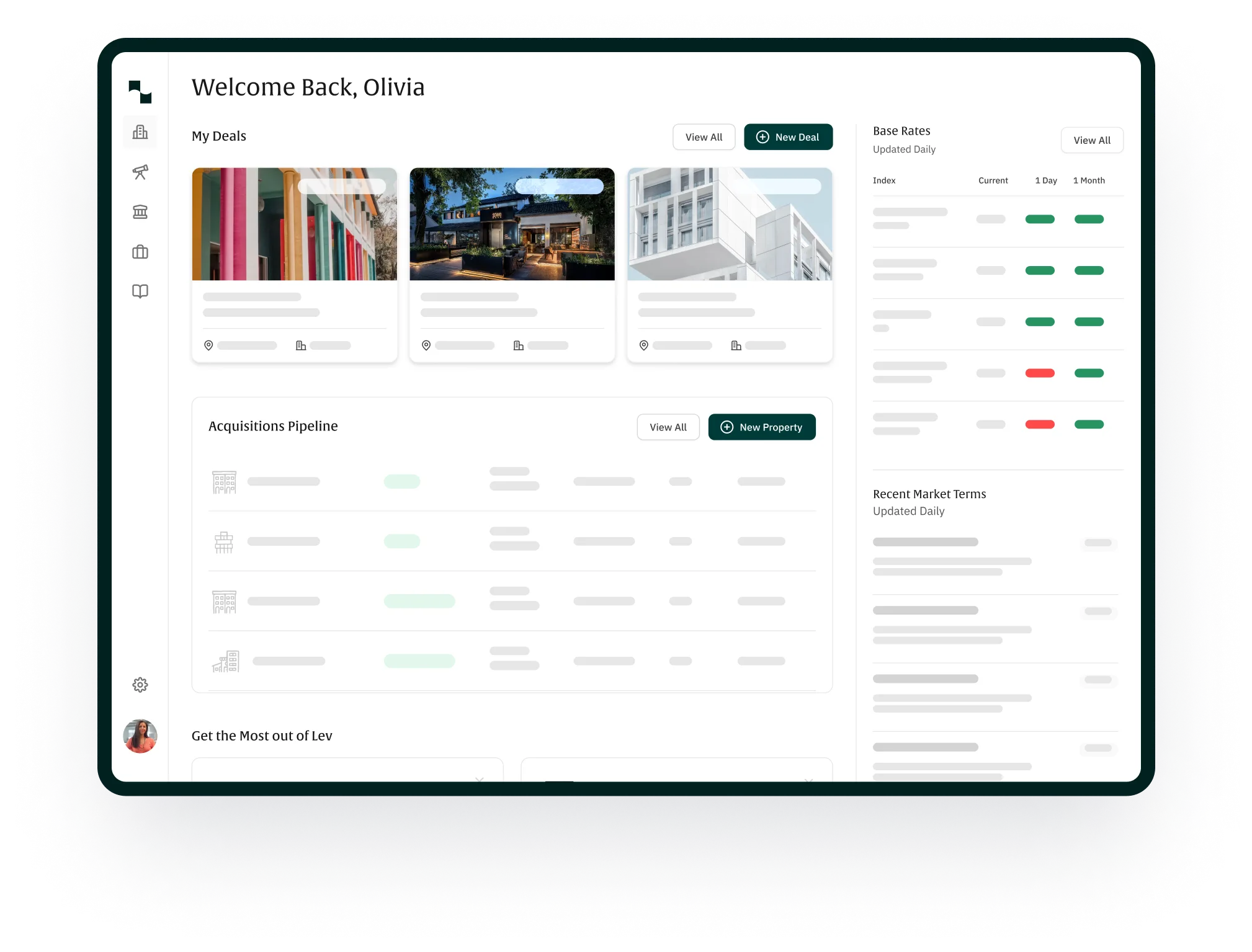

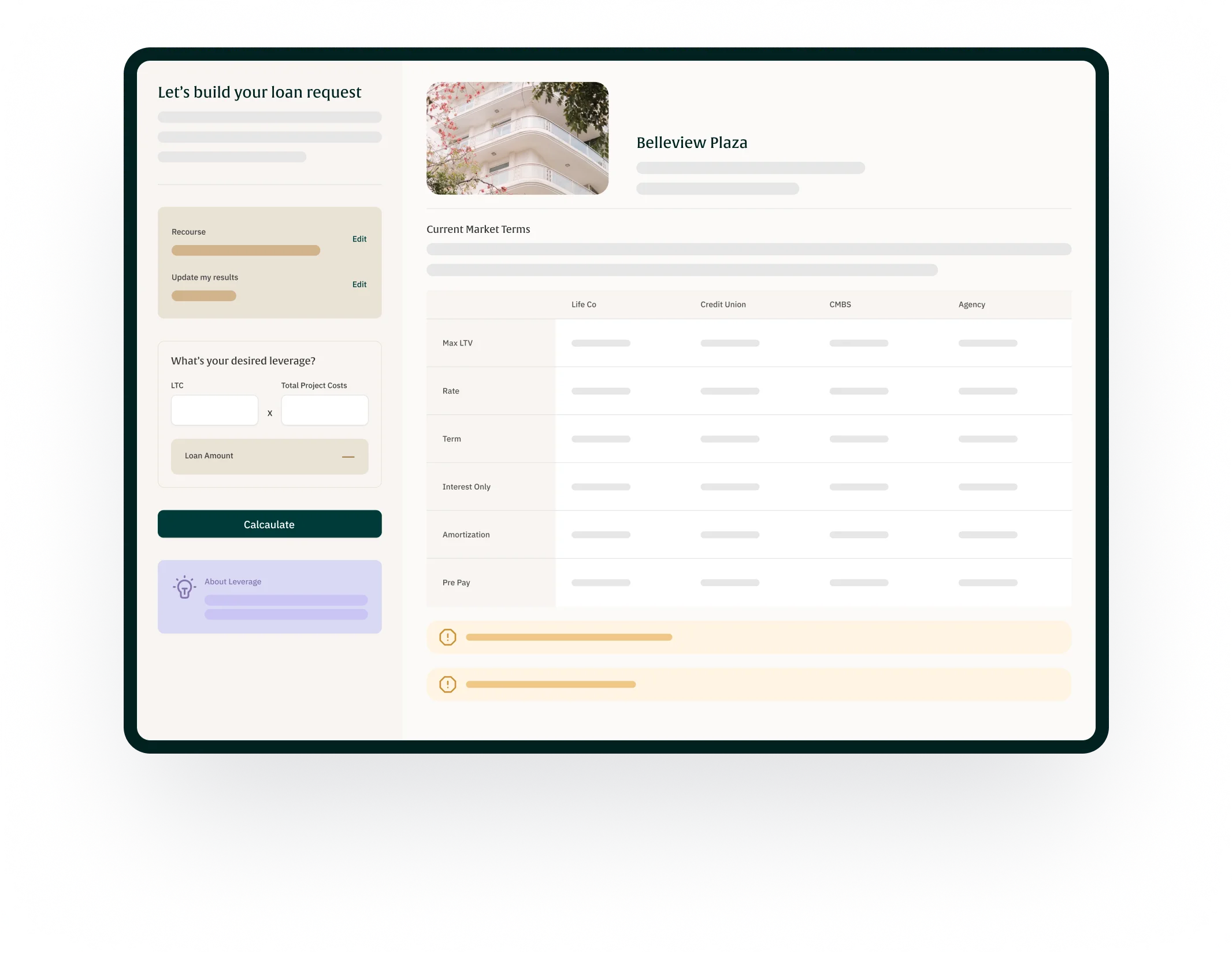

Real-Time Market Data: Users have access to up-to-date lender programs, recent transactions, and verified contacts from over 4,000 lenders. The main dashboard gives a snapshot of base rates across indexes and anonymized recent terms as deals get quoted in the market.

Automated CRM: The platform includes relationship tracking through an integrated CRM, ensuring all deal and contact information is accessible in one place. CRM records are automatically updated through Lev’s real-time data feed. Users can connect their email directly to the platform, allowing easy relationship tracking. Users can also create custom email templates and prompts for better communication.

Loan sizing: Before deals are sent out to lenders, users can take advantage of an interactive loan sizing tool, highlighting how small changes to financing requests can unlock additional lender matches and more competitive programs.

Lender Matching and Insights: AI-driven matching connects users with optimal lenders, offering detailed profiles that include recent transactions and lending criteria.

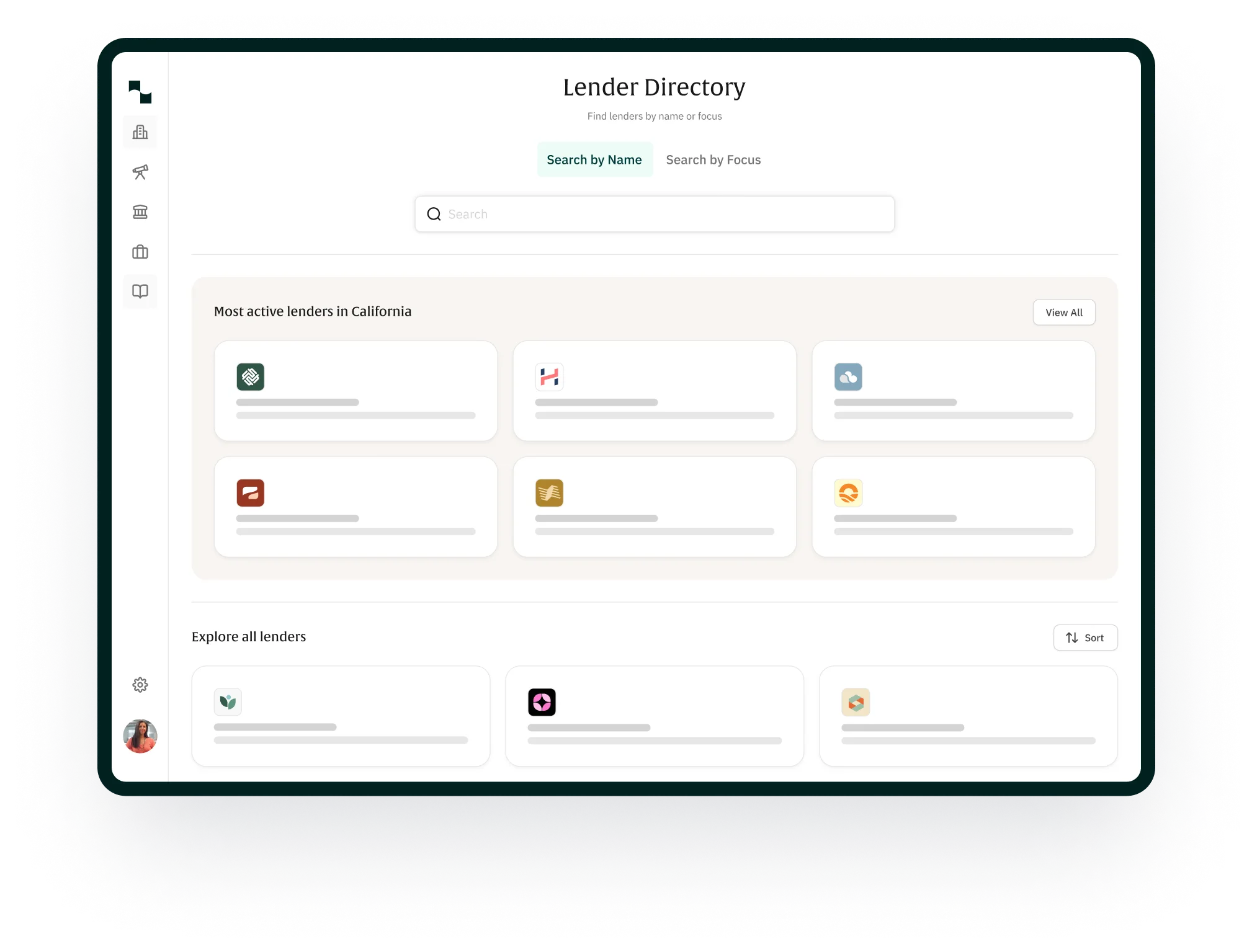

Lender Search: Outside of lender matches on live deals, users can also search Lev’s extensive lender database by name, location, or area of focus. Lender profiles provide historical lending data in visually appealing charts and graphs, allowing users to understand the lender landscape fully.

Automated Deal Materials and Workflows: Lev’s AI-powered tools automate deal material creation, allowing users to upload documents and quickly generate polished, customizable deal books. This feature alone can save sponsors and brokers hours of work. The platform also streamlines deal management with automated workflows, generating action items, follow-ups, and real-time deal tracking, improving lender response rates and keeping deals on track.

Pipeline Management: Lev provides tools to manage the entire CRE deal lifecycle, from prospecting to securing term sheets. The platform allows users to track properties under consideration and easily convert pipeline opportunities into active deals.

User Experience

Lev is a user-friendly platform that helps sponsors and brokers simplify financing. Its visually appealing user interface and intuitive features make it an easy tool for most users. Users can simply track active and past deals, manage lender relationships, and create debt packages for lender review. Lev makes using AI in the financing process very easy to adopt.

Customer Support

All Lev customers are assigned a customer success manager who helps with onboarding, deal support, and ongoing strategic account advice. Lev also offers a “Deal Assistant,” where its team contacts lenders who haven’t responded to deals, freeing up sponsors’ and brokers’ time from endless follow-ups.

Pricing

Lev’s subscription pricing model is tied to the volume of transactions that sponsors and brokers launch through the platform. Pricing starts from $12k annually. Both sponsors and brokers have a free trial period to test the platform before committing to a subscription. Sponsors have the added benefit of adding Lev’s annual fee to the closing costs of one or more loans in the same way that broker fees are paid.

Competitors

StackSource

StackSource is an online platform that connects commercial real estate borrowers with lenders. It offers tools to match clients with the best financing options from a network of over 3,500 capital sources. Users can access debt, equity, and gap capital solutions using the platform and view daily updated commercial mortgage rates. StackSource simplifies securing real estate financing by combining technology with expert advisory services to optimize funding deals.

GPARENCY

GPARENCY is a membership-based commercial mortgage brokerage offering flat-fee services to help clients secure financing for CRE deals. They provide options like “Shop My Deal” for a fixed fee of $4.5k, where they source financing options and deliver term sheets, and “Broker My Deal,” where they manage the transaction for half a point capped at $100k. GPARENCY operates like a tech-enabled brokerage that competes directly with brokers but doesn’t let sponsors run their deals.

FAQs

Lev is a software platform for CRE financing that combines the industry’s largest source of real-time lender data with purpose-built CRM and workflow optimization tools.

Lev is designed for CRE sponsors and brokers seeking to build and manage lender relationships and save time in the financing process.

Lev provides access to a network of over 4,000 lenders, including regional, national, and specialized institutions.

Lev caters to CRE deals of any size, offering tools that scale to various transaction sizes.

Lev offers potential users a live demo with a sales representative and a free trial before they commit to a subscription.

Lev’s subscription pricing model is tied to the volume of transactions that sponsors and brokers launch through the platform. Pricing generally starts from $12,000 per year.

How We Evaluated Lev

When evaluating Lev, we examined several factors, including:

- Product and service offerings: We dug into Lev’s features, products, and services, including its full suite of financing and CRM tools.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make Lev stand out from its competitors.

- Ease of use: We examined how user-friendly Lev’s platform is, how intuitive the onboarding process can be, and how quickly a new user will likely understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated Lev’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined how Lev products and services are priced and whether readily available pricing info is available on its website.

Summary of Lev Review

Overall, Lev’s combination of lender data, centralized deal management, and automated workflows make it a powerful solution for CRE sponsors and brokers. Sponsors looking to establish long-term lender relationships while maintaining control over the deal lifecycle will find Lev especially beneficial. Lev’s ability to automate, customize, and track every step of the deal process makes it a compelling choice for CRE sponsors and brokers looking to streamline their financing workflows.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!